Applying "The Four-Way Test" In Life And Money

I don’t know what I was expecting when I went to my first Rotary Club meeting, but it’s not what I found.

I suppose I’d deemed such groups as ineffectual, outdated, self-serving, and salesy. But when a friend invited me—a longtime Rotary veteran at the Roswell, Georgia Club who didn’t seem to exemplify any of those characteristics—I decided to give it a shot.

What I’ve learned through this exploration is something I’m compelled to share with you, because I think there’s a lesson, maybe lessons, to be applied in your life, work, and even how you manage household financial discussions and decisions.

Are you familiar with the Rotary “Four-Way Test”? If not, I think you’ll want to check this out—and even if you are familiar, this might provide you with a new lens through which the test can be applied.

And Tony will tell us what it means that “U.S. Leadership Is Breaking Down on an Equal-Weighted Basis” in this Weekly Market Update.

Thanks for joining us, and for pulling for Samuel L. Jackson’s favorite football team this weekend!

Tim

Tim Maurer, CFP®, RLP®

Chief Advisory Officer

In this Net Worthwhile® Weekly you'll find:

Financial LIFE Planning:

Applying “The Four-Way Test” In Life And Money

NWWW Podcast (Replay):

How AI Is Redefining Financial Planning

Quote O' The Week:

Herbert J. Taylor

Weekly Market Update:

U.S. Leadership Is Breaking Down On An Equal-Weighted Basis

Financial LIFE Planning

Applying “The Four-Way Test” In Life And Money

My first impression of Rotary wasn’t necessarily bolstered as I parked my car outside of the municipal gymnasium, but as I opened the door, I was greeted by a buzz of positivity. The proceedings were, indeed, held in a space that seemed better suited for a middle school basketball tournament, but it was packed with around 250 men and women of various ages and ethnicities, and the one thing they seemed to have in common was that everyone wanted me, and several other visitors, to feel welcome.

Service Above Self

As the meeting came to order, the foremost core tenet was announced, and it began to shift my perspective: “Service above self,” they insisted, was the way of the Rotarian.

Apparently, the phrase was originally introduced conversationally at a Rotary convention in the early 1900s, and became one of two official mottos in 1950, joining “He Profits Most Who Serves Best.” Then, in 1989, “Service above self” became the principal motto because it best conveys the philosophy of unselfish volunteer service. And I felt it in the room. There was something different, something genuine, about this group.

This sense was amplified when I decided to get involved with the Roswell Rotary Club’s annual fundraiser a few weeks later. The idea—a day of golf, tennis, and pickleball—wasn’t particularly novel, but the outcome left my mouth agape when I heard that they raised more than $200,000 for local charities. Two hundred grand!

And although this was the largest event of the year, it seemed like there were events and opportunities for service at least weekly that always drew a crowd, whether it was doing cleanup on the Chattahoochee River, learning about the work being done to fight human trafficking in Atlanta, mentoring in local area high schools, filling provisioned backpacks for homeless veterans, or playing cornhole to promote the eradication of polio internationally—a cause to which Rotary International members have given more than $2.7 billion! (BTW, ask me who won the cornhole tournament.)

Four Guiding Questions

As if I needed further proof that these people were for real, every meeting is closed with a joint recitation of The Four-Way Test. Originally the brainchild of Rotarian Herbert J. Taylor, who used the Test to help turn around the Club Aluminum Products Company facing bankruptcy in 1932, Taylor gave Rotary the rights to use the test in 1942 and ultimately transferred the copyright. Here it is:

“The Four-Way Test of the things we think, say, or do

First…is it the TRUTH?

Second…is it FAIR to all concerned?

Third…will it build GOODWILL and BETTER FRIENDSHIPS?

Fourth…will it be BENEFICIAL to all concerned?”

Would you sit with that for a moment? Would you consider how many of the challenges we face today—in businesses, schools, communities, politics, and interpersonal relationships—could be muted if there was even the slightest attempt to adhere to this simple standard? And what if it actually became a societal rule, a central code?

Well, in Rotary, I’ve witnessed it—at least in the Roswell, Georgia Club. Despite the fact that everyone in the room comes from different personal, educational, religious, political, age, and racial backgrounds, it feels like a place where the labels are left at the door, even despite the fact that this civic group regularly invites an ecumenical spectrum of religious affiliates to lead the invocation each week and often features local, state, and even national politicians as speakers.

It also got me wondering: How can we apply this Four-Way Test in a smaller space, the space over which we have the most agency—our homes and families? And could we drill down even further, considering the very specific application of the Test in navigating one of, if not the most, explosive topics in our closest relationships—our money?

Money has a unique power in our relationships, as both a tool for flourishing and one of the most divisive forces. So how might The Four-Way Test be applied in this specific domain?

Application: The Four-Way (Financial) test

Is it the TRUTH? How can we foster greater honesty in our financial conversations? What are we actually spending? Is that spending in alignment with our values? What are our very real financial fears? What are we hiding or avoiding? I realize this leads us into some very vulnerable territory, but genuine vulnerability is one of the key ingredients to lasting trust, and it’s the breakdown in trust that so regularly leads to financial strife and division in our households.

Is it FAIR to all concerned? How do we foster fairness in financial decision-making? How can we create space for degrees of spending autonomy as well as standards for transparency? Most households tend to have one, not two, “financial spouses,” but how do we ensure that both have a financial voice in the relationship?

Will it build GOODWILL and better friendships? Money conversations can either strengthen or erode trust and intimacy. One of the most powerful unifying traits to be employed in healthy money management is grace. Money management is really an exercise in mistake management, requiring constant calibration, and therefore developing our system with grace at its core and margin as its primary ingredient helps us build goodwill, rather than demonizing our partners for their financial missteps.

Will it be BENEFICIAL to all concerned? Too often, family financial systems are built around the goals and values of the “financial spouse,” but it’s important that these systems serve the family’s shared values, not just individual wants. As a result, input from every person in the household, children included, typically results in the healthiest interaction around money.

In that gymnasium in Roswell, I was struck by something I hadn’t expected: a group of people from wildly different backgrounds who’d actually figured out how to operate from a shared ethical foundation. Not perfectly, not without friction, but genuinely. So, I’m pleased to report that, as of this week, I was one of three new members inducted into the club.

That same alchemy is possible in our homes. Money will always require hard conversations. It will always surface our fears and foibles, but also our values and priorities. And what if those conversations operated from the same framework Rotarians have used to move mountains together? Asking not “How do I win?” but “What serves us all?”

Service above self, when applied to the people we live with, means choosing honesty over convenience. It means sacrifice over dominance. It means building systems designed around shared flourishing, not individual control. It means extending grace to ourselves and each other as we learn and recalibrate.

That’s not naive idealism. That’s the hard, daily work of treating money as what it actually is: a tool for growing, protecting, living, and giving.

This post was initially published on Forbes.com.

NWWW Podcast (Replay)

Has AI impacted your life and work yet? It surely has mine. We use it to plan household projects; it is my wife’s foremost consultant in her growing business in Atlanta; and it is my personal research assistant for everything I create.

It’s also reshaping how financial planning and investing are done. And while some are asking the question, “Will AI eventually replace financial advisors?” I think the most likely answer is: “AI won’t replace financial advisors, but financial advisors who use AI will replace those who don’t.”

About a month ago, I had the opportunity to talk to a long-time financial industry veteran leader who has gone all-in on AI, so ICYMI, I wanted to give you a replay this weekend:

Quote O' The Week

Herbert J. Taylor, a Chicago businessman and Rotary International president, proved that a simple ethical framework could save a failing company and ultimately reshape how millions approached business, family, and life.

“We have found that you cannot apply The Four-Way Test continuously to all your relations with others eight hours each day in business without getting into the habit of doing it in your home, social, and community life. You thus become a better father, a better friend, and a better citizen.”

Weekly Market Update

All the equity indices we track were in the red this week. Tony clues us in below:

- 1.95% .SPX (500 U.S. large companies)

- 0.85% IWD (U.S. large value companies)

- 0.79% IWM (U.S. small companies)

- 0.47% IWN (U.S. small value companies)

- 2.46% EFV (International value companies)

- 2.11% SCZ (International small companies)

+ 0.60% VGIT (U.S. intermediate-term Treasury bonds

U.S. Leadership Is Breaking Down on an Equal-Weighted Basis

Contributed by Tony Welch, CFA®, CFP®, CMT, Chief Investment Officer, SignatureFD

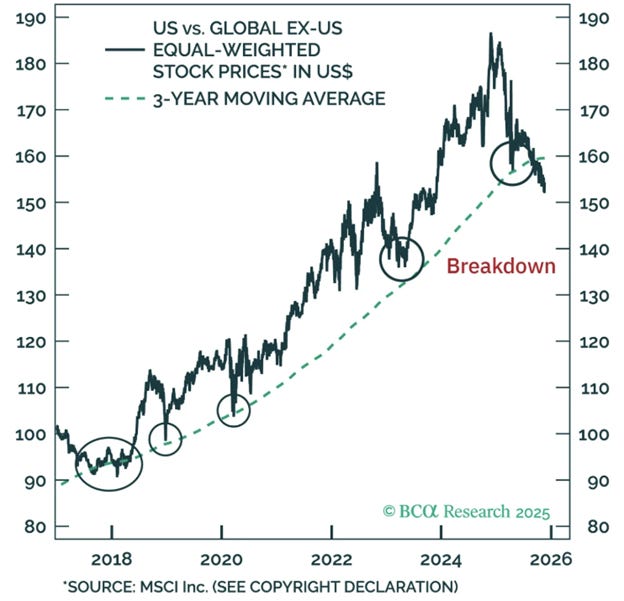

This week’s chart highlights a meaningful shift beneath the surface of global equity markets. On an equally weighted basis, U.S. outperformance relative to the rest of the world peaked near the end of 2024 and has been trending lower ever since. That means the average international stock has been outperforming the average U.S. stock for about a year.

The chart also shows that the long-standing uptrend, measured by the three-year moving average, has broken for the first time since 2018. Historically, that moving average has acted as support during prior pauses in U.S. leadership, but this time the ratio failed to hold. The breakdown suggests U.S. relative performance is no longer just consolidating but may be evolving into a more durable shift in favor of international markets.

Even on a cap-weighted basis, the U.S. has slipped against global peers this year, but the equal-weighted view makes the rotation clearer. Mega-cap strength has masked the degree of change occurring under the surface. When every stock counts the same, the leadership handoff points to a broadening advantage for non-U.S. equities.

For globally diversified investors, this creates a very different backdrop than the one that dominated the past decade. The question from here is whether the U.S. finds its footing or whether the recent trend continues and forces a more structural rethink of global equity allocations.

Chart O’ The Week

The Message from Our Indicators

The data this week continues to point to an economy that is slowing around the edges but still carrying enough momentum to support growth as we head toward year-end. Construction activity remains muted overall, even with a slight uptick in residential remodeling. Architecture billings continue to contract, and the forward indicators for nonresidential spending remain soft, implying that 1H 2026 will likely bring more of the same. At the same time, manufacturing sentiment is improving in select regions, with the Empire State survey showing the strongest reading in a year and an encouraging rebound in capital spending plans. Globally, Japan’s Q3 contraction reinforces the case for additional stimulus, while trade data show ongoing reshuffling of global supply chains, not genuine reshoring.

Labor market signals are becoming more mixed. Payrolls surprised to the upside in the latest report, and the breadth of hiring across industries improved, which supports the durability of the expansion. But the unemployment rate has drifted to a four-year high and continuing claims have been grinding higher. Several months of softening in full-time employment point to emerging labor market slack. Historically, an unemployment rate modestly above estimates of full employment has been disinflationary, which is consistent with the recent cooling in wage growth. This dynamic helps keep overall inflation pressures from accelerating, even with tariff passthrough still a potential source of friction next year. These crosscurrents also leave the December rate decision finely balanced, although anchored long-run inflation expectations mean the bar for additional easing in 2026 remains low.

Corporate fundamentals continue to look constructive. With roughly 84 percent of S&P 500 companies having reported, sales growth of about 8 percent and earnings growth of roughly 14 percent point to ongoing margin expansion. This strength is concentrated in areas tied to AI infrastructure and technology adjacent spending, which remain the key stabilizers for overall index-level earnings. The broader backdrop still reflects the ongoing effects of rolling sector-level recessions, but the low base in areas like Staples, Materials, Energy, and parts of Health Care creates an easier setup for 2026. A healthy mix of firming capital expenditures, easing financial conditions, and tech-led productivity improvements supports the view that the profit cycle remains intact for now, even if the pace moderates next year.

Market action has been more rotational than corrective. The recent pullback, about 5% off the highs, has not meaningfully damaged the uptrend, although breadth has weakened. Fewer stocks are holding above their respective intermediate-term moving averages and other measures of market participation have slipped to multi-month lows. Leadership has also become more unstable, with large-cap Growth weakening after a long run of dominance, while Value and mid caps showing signs of relative improvement. The market also bypassed the usual autumn seasonal softness, which means it did not reset into oversold territory before the latest consolidation. As long as earnings remain supportive, pullbacks are likely to stay contained, but prolonged weakness in breadth raises the probability that consolidation evolves into a more meaningful topping pattern.

Looking ahead to 2026, several themes from the outlook work their way into the watch list. The current bull market is entering a more mature phase, valuations are elevated, and labor market softening could become a more significant macro headwind. Next year is also a mid-term year, which tends to be a weaker part of the presidential cycle, and the potential transition to a new Fed chair may inject uncertainty into policy communication. At the same time, the AI capex boom remains a powerful offset and has the potential to extend the expansion if productivity gains broaden beyond the largest firms. For now, we believe the weight of the evidence remains supportive of equities, but the list of items that merit closer monitoring as we move into next year continues to grow.

Can you believe that we’re already saying thing like, “Looking ahead to 2026…”!? So, let’s make the most of the rest of 2025, starting this weekend!

Tim

Hey, great read as always. I really appreciated the mention of 'How AI Is Redefining Financial Planning'. It's so cool to see these traditional principles like the Four-Way Test intersect with cutting-edge tech. Shows how adapteble good ethics are, even for something as dynamic as AI.