How Many Things Have To Happen To You?

Robert Frost's Insight Leads Us To Financial Wisdom

I just finished a book that struck me profoundly enough that I’m not ready to process the thoughts and emotions through writing just yet. Hopefully soon.

(It’s called Tattoos On The Heart, by the way, written by Greg Boyle, the founder of Homeboy Industries, the largest gang rehabilitation program in the world.)

In the interim, it was in this book that I caught a quote from Robert Frost that is the subject of this week’s Financial LIFE Planning article. Frost asks us a question that is sure to pierce our minds (if not our hearts) if we let it. (Even if you’re short on time this weekend, please scroll below, if only to consider this question.)

In addition to that, Tony has a timely insight in his Weekly Market Update, and we teamed up again for a conversation on this week’s podcast, When Worry Follows Winning, which answers the question on many people’s minds: Is it time to take some gains off the table?

Oh, and I hope you had a great Thanksgiving last week! In case you were too busy sleeping in, eating leftovers, shopping, or watching football, you might want to check out last week’s edition, too:

Thanks for joining us this weekend!

Tim

Tim Maurer, CFP®, RLP®

Chief Advisory Officer

In this Net Worthwhile® Weekly you'll find:

Financial LIFE Planning:

How Many Things Have To Happen To You?

NWWW Podcast:

When Worry Follows Winning

Quote O' The Week:

Maya Angelou

Weekly Market Update:

What’s The Harm in Getting Defensive Too Early?

Financial LIFE Planning

How Many Things Have To Happen To You?

“How many things have to happen to you before something occurs to you?” Robert Frost once asked. This pointed question is one of many instances in history where someone with the gift of wisdom addressed an issue that would only be explained through science many years after.

But before we talk through the dynamics at work in our decision-making, let’s pause on the question itself again. When you think about your own life and financial decisions, “How many things have to happen to you before something occurs to you?”

Are you the type of person who is happy to learn from others, or do you have to always “learn it the hard way”? Do you tend to be a fast processor or a slow burner? Are you proactive or prone to procrastination?

Regardless of your decision-making predisposition, the work of Prochaska and DiClemente gave us a view of how we all process this stuff, a process with one of the fancier titles in behavioral science.

The Transtheoretical Model

Let’s do a quick walk through the model, using the simple example of saving money for the future as our lens.

Precontemplation — You have no awareness of a problem, and no intention to change. Maybe this phase should be called denial? 😊 — “I don’t have a spending problem.”

Contemplation — You’re aware that something needs to change, but largely ambivalent, weighing pros and cons. — “Maybe I should start saving more...”

Preparation — You’re intending to take action soon, making small steps. — “I’ve been looking at 401(k) options.”

Action — Now we’re getting somewhere, actively modifying behavior. — “I just set up automatic contributions.”

Maintenance — We now work to sustain the new behavior, preventing relapse. — “I reviewed the new fund options, reallocated, and triggered auto-escalation, so that my contribution will increase slightly every year.”

Some versions of the model include one additional step, Termination, for situations in which a new habit has become so ingrained that it no longer requires attention, but I’d argue that in the realm of personal finance, this rarely happens.

Life Events As Triggers For Financial Action

Good financial habits typically require ongoing maintenance, because money rules (like tax code, estate law, retirement contribution limits, and Social Security) are ever-changing and, more importantly, it’s typically life events that trigger financial decisions, and not the other way around.

My viewpoint within the industry—observing hundreds of clients make thousands of decisions—suggests that it is events and life transitions like these that most often trigger financial action:

The birth of a child or grandchild

A diagnosis or disabling injury

A marriage or a divorce

The death of a parent (especially watching how their good/bad planning impacts the whole family)

An inheritance (which often carries emotional weight beyond the dollars)

Kids leaving for college

Losing (or gaining) a job (or receiving a promotion or demotion)

Retirement, or watching a colleague retire

Going on a major international trip

Selling a business

And this list could go on and on (and on). Sure, there are financial events that will also trigger action, like a major market drop, the receipt of a surprise bonus or inheritance, but most of our money moves are catalyzed by life, rather than financial, events.

There’s another unique twist, because the life or financial events that tend to really grab our attention and move us to action aren’t the ones accompanied by congratulations, but by consolations. Yes, according to Kahneman and Tversky’s work, pain or loss (and its anticipation) is found to impact us more than joy or gains by a ratio of at least two-to-one.

Closing The Gap—From Ignorance To Action

So, are we destined to wallow in ignorance and indecision as humans, or is there something we can do to close the gap between happening and occurring, between insight and action?

Indeed. Let’s consider a handful of methods for application:

Borrowed experience

You don’t have to wait for your own crisis or windfall. In fact, much of the stress that holds us back from insight and action is the unknown and inexperience. But through borrowed experience, we can allow things to occur to us through the experience of others. When you hear a higher-earning friend bemoan the job that is stealing their joy, or sit with a friend navigating a parent’s decline, or read about someone at the age of 75 who undersaved and has few favorable options remaining, you can let what is happening to them occur to you.

The one thing we have to be careful about in this domain is allowing too much input to lead us to analysis paralysis. Here, we must do the work of discernment, choosing which inputs we invite into our lives, because I’d wager the remaining stress that doesn’t come from the unknown often comes from the noise around us.

Structured reflection

Most people never pause long enough to examine their financial lives with any rigor. Tools like George Kinder’s three questions, or regular “life audits,” journaling practices, and intentional conversations (often invited by the best financial advisors) can surface what’s already there but unexamined. The insight is often waiting, but needs the space to emerge.

Pre-commitment and automation

Once something has occurred to you, capture it immediately. The contemplation stage can be unstable, as motivation that has not progressed to action fades. Automation (auto-enrollment, auto-escalation, automatic transfers) locks in the insight before apathy rears its ho-hum head. Through automation, we can make a series of great future decisions in a single instance.

Richard Thaler and Shlomo Benartzi’s work speaks to the increased retirement saving power of availability, automatic enrollment, automatic investment, and automatic escalation; and a Vanguard study showed that auto-enrollment more than doubled plan participation rates from 42% to more than 91%!

Accountability relationships

An advisor, a spouse (although you have to be careful here), a financial accountability partner—someone who will ask the hard questions and hold you to what you said mattered. Left to ourselves, we often drift back to precontemplation, but in partnership and community, we ensure our best intentions.

Dr. Gail Matthews at Dominican University found that “more than 70% of the participants who sent weekly updates to a friend reported successful goal achievement (completely accomplished their goal or were more than halfway there), compared to 35% of those who kept their goals to themselves, without writing them down.”

Creating your own deadlines

Life events create natural forcing functions, but you can also manufacture them by scheduling an annual or semi-annual financial review, tying action to a birthday, or making a semi-public commitment.

From Happening To Occurring

We could read Frost’s question as an indictment of human sluggishness, but there’s another way to consider it: as an invitation. You don’t have to wait for more things to happen. You can choose, today, to pause long enough to consider how that which happens to you could be a lesson to be applied through action.

The good news is that the tools above aren’t complicated, but intellectual honesty is a muscle we don’t naturally flex. Our default is to a presumption of personal innocence and a preference for inaction.

Yet while the gap between happening and occurring can’t be magically eliminated, it can be shortened. And often, the first step is simply deciding that you’d rather learn from wisdom than from pain.

NWWW Podcast

Ironic, isn’t it, that when markets seem to be doing precisely what we’d hope, our tendency is to stress out over precisely when the winning streak is going to end. So Tony and I tackle that very topic in this week’s new podcast.

Quote O' The Week

Maya Angelou was a poet, memoirist, and civil rights activist who, before becoming one of America’s most celebrated literary voices, worked as a streetcar conductor, a cook, a nightclub singer, and a coordinator for the Southern Christian Leadership Conference alongside Martin Luther King Jr.

Weekly Market Update

Markets were mixed, but mostly (marginally) higher this week as investors weigh whether Santa will deliver a year-end rally. Below, Tony further addresses a healthy posture for investors eyeing indices at or near their highs:

+ 0.31% .SPX (500 U.S. large companies)

+ 0.23% IWD (U.S. large value companies)

+ 0.81% IWM (U.S. small companies)

+ 0.85% IWN (U.S. small value companies)

+ 0.65% EFV (International value companies)

- 0.04% SCZ (International small companies)

- 0.78% VGIT (U.S. intermediate-term Treasury bonds

What’s the Harm in Getting Defensive Too Early?

Contributed by Tony Welch, CFA®, CFP®, CMT, Chief Investment Officer, SignatureFD

We have noticed an uptick in client concerns over the market direction next year. Strong gains since 2022 have left stocks at least somewhat overvalued, and there is an intuitive sense that the party must end at some point, right? But as we explain often, markets do not make it easy for us.

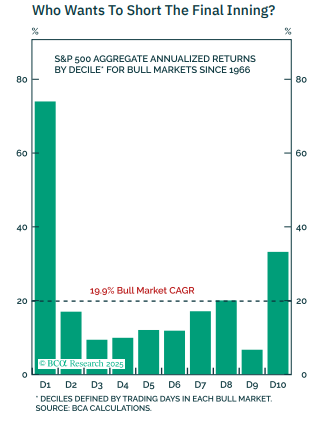

One may logically ask, what’s the harm in getting defensive too early? The chart below helps to quantify the answer. It splits up all bull markets into 10 equal time periods for each respective bull run. The green bars show the annualized returns in each segment. The interpretation is that the strongest returns have tended to occur in the initial tenth of the advance as the market sharply rebounds from the prior bear market. That is an interesting piece of data, suggesting that if one remains defensive for too long, they are likely missing out on the strongest part of an advance.

But equally as interesting, the next strongest period for a bull market has been the final tenth. The implication is that if one were to miss the final move higher, they are potentially leaving significant gains on the table. Bringing it together helps to showcase why we just want to stay invested through full market cycles with our Grow capital. Bull markets are relatively lifeless in the middle innings. The strongest gains were the bookends. And if you are trying to time markets, there is a solid probability of missing either the first tenth or the last tenth, maybe even both.

Chart O’ The Week

The Message from Our Indicators

Economic data continues to suggest that the expansion is intact, but there are some late-cycle characteristics. Manufacturing slipped further into contraction territory, with weakness in new orders, backlogs, and employment, while services improved to a nine-month high and remain the key driver of real GDP growth. Inflation signals across these surveys were mixed, also adding some murkiness to the outlook for Fed policy in the upcoming year. Industrial production is essentially flat month-to-month, but modestly positive year-over-year, and capacity utilization remains below long-run norms, consistent with weaker inflation pressures.

Labor market indicators also show cooling beneath solid headline data. Initial claims remain near multi-decade lows, yet announced job cuts have risen and ADP private-sector payrolls have declined in three of the last four months, led by small businesses. Consumers remain sensitive to price levels: light vehicle sales continue to run below last year’s pace as affordability pressures weigh. Internationally, Japan’s policy shift toward a tightening bias is gradually unwinding the long-standing yen carry trade, a structural change that may add pockets of volatility to global markets.

On the fundamental side, earnings trends remain broadly supportive, but valuations leave less cushion. The S&P 500 price-to-earnings ratio has moved near the top of its historical range, and price-to-sales is at a record. Median valuations look more reasonable, but the largest growth and AI-linked names are priced for very strong execution. Globally, trailing earnings are still rising, yet forward earnings growth has stabilized, and the global price-to-earnings ratio has risen to its highest level since 2021.

Technicals continue to reflect a market influenced by both positive seasonal tailwinds and potentially negative narrowing participation. The recent correction reset stretched conditions, pushing sentiment into a more pessimistic setting and aligning the index more closely with its typical post-election-year pattern, which often features a stronger second half of December. That said, breadth remains subdued, similar to late 2021 and 2024, periods that preceded more uneven performance. For now, the indicators point to a constructive near-term backdrop but we will continue to monitor the labor market, fiscal and monetary policy, as well as corporate earnings for any changes to the constructive message.

Hoping your weekend is providing a “constructive near-term backdrop”!

Tim