If You’re Never Wrong, You’re Not Learning Enough

One of the wiser, more experienced financial advisors I have the pleasure of working with mentioned something to me this week that I had to stop and write down so that I could share it with you:

“I like to be wrong, because that means I’m learning.”

He substantiated his claim by telling me how he chooses to read books and articles, and listen to podcasts and interviews, that are in direct opposition to his current opinions, both to reinforce and challenge his thinking.

If this sounds foreign to you, it’s because it doesn’t come naturally. We’re actually prone to quite the opposite of this behavior. You may have heard, for example, of the confirmation bias—the idea that we, as humans, tend to subconsciously seek information that will confirm the opinion we already hold, while filtering out that which might challenge our pre-existing positions.

In this week’s Net Worthwhile® Weekly, we’ll offer a 3-Step Assumption Test that can help us expand our ideation before (Re)Testing 4 Common Financial Planning Assumptions and why they may be worth revisiting—all through the lens of behavioral finance. And Tony brings his wisdom in a Weekly Market Update focused on the impact of disinflation on the current markets.

Thanks for spending a portion of your precious weekend with us!

Tim

Tim Maurer, CFP®, RLP®

Chief Advisory Officer

In this Net Worthwhile® Weekly you'll find:

Financial LIFE Planning:

If You’re Never Wrong, You’re Not Learning Enough

Net Worthwhile® Podcast:

The Human Side Of Money

Quote O' The Week:

Friedrich Nietzsche

Weekly Market Update:

Disinflation Intact…For Now

Financial LIFE Planning

If You’re Never Wrong, You’re Not Learning Enough

Why Are We So Afraid Of Being Wrong?

We simply don’t like to be wrong. It threatens our credibility and creates a vulnerability within and exposes us to potential embarrassment without.

It is important to note that most of our apparent human bugs are also, in some way, features. Even confirmation bias. For example, if all we did was go through our days questioning every assumption that has built itself into our worldviews, we’d suffer from analysis paralysis, and rarely do anything. So, perhaps the discipline to be applied here is the practice of regularly choosing to test our assumptions.

Therefore, before we take a glance at four commonly held assumptions in the arena of personal finance that may be worth reconsidering, let’s offer a simple method for safely testing our assumptions that we can use in any area of life or work.

The 3-Step Assumption Test

1. Name It

Identify and clearly state the assumption you’re making. “All Pittsburgh Steelers fans are annoying,” for example, may feel substantiated when you see someone in head-to-toe black and gold long after football season. 😊

But unexamined assumptions like this often lead to poor thinking and bad decisions—and maybe even unnecessary arguments.

Status-quo bias is a powerful force that threatens to render us just another confirmatory voice in a one-dimensional echo chamber.

2. Flip It

Stress-test your assumption by asking: What if my assumption is wrong, either wholly or partially? What evidence supports or challenges the opposing belief?

More seriously on this point, one example the “I like to be wrong” advisor gave me was his exploration of the work of Nietzsche, a philosopher whom he foreknew held firm beliefs that were in direct opposition to his well-established worldview. But he read him anyway, and while the foundation of his worldview didn’t crumble, he did pick up some new insights that he’d never have received if he rejected the writer’s influence completely.

This step counters confirmation and overconfidence biases; it makes us more malleable and adept thinkers and more approachable collaborators.

3. Test It

Run a small, low-stakes experiment to see how the assumption holds up in practice. Don’t allow your lightbulb moment to fall short of genuine illumination—put your revised assumption to the test.

For example, my wife and I just explored a challenging notion related to marriage—that we each bring an (often) unspoken collection of hopes, dreams, and desires to any relationship, and that without even knowing it, those silent aspirations tend to manifest as an insurmountable wall of expectations that no partner could ever crest. We were invited to test this assumption simply by asking our spouse, “What is in your hopes, dreams, and desires ‘box’”?

The Bayesian updating theorem provides us with an actual formula for testing and updating prior assumptions based on new information…which is a fancy way of saying we should adjust our beliefs as new information comes in.

Now let’s take this 3-step test for a spin in the world of personal finance, where a handful of common assumptions are worth putting under the microscope.

(Re)Testing 4 Common Financial Planning Assumptions

As we often do, we’ll use a fourfold mental model to navigate our way through the financial landscape:

GROW

Common Assumption: “The best investments are the ones with the highest past returns.”

Supporting Biases: Recency bias and performance chasing tend to lead investors to simultaneously overweight recent returns and expect trends to continue.

Sure, you’ve likely heard the disclaimer that “past performance is no indicator of future results,” but I still bet when you looked at your 401(k) options, you ran your finger all the way over to the right to prioritize the investments with the highest returns.

And while past performance absolutely should be part of any thorough investment analysis, the fact remains that every individual stock, mutual fund, or ETF has its own set of goals—and they may be different from yours.

PROTECT

Common Assumption: “Insurance is wasted money if I don’t use it.”

Supporting Biases: The theory of loss aversion, first enumerated by Daniel Kahneman, helps explain why we tend to experience the pain of paying insurance premiums more acutely than the (invisible) relief of avoiding a catastrophic loss.

We’ve been trained, especially in the financial realm, to think about the ROI (Return On Investment) of everything we do, but this logic breaks down when considering insurance. While some insurance products do provide an ROI in various forms, the primary purpose of most insurance is to transfer risk—to not lose money, rather than to make it.

For example, it’s true that only 2% of term life insurance policies ever pay claims—but that’s good news, friend, because it means you didn’t die!

GIVE

Common Assumption: “I’ll start giving once I’ve accumulated more.”

Supporting Biases: Impact bias is the tendency to overestimate both the intensity and the duration of our emotional reactions to future events—positive or negative. In other words, we think outcomes will affect us more, and for longer, than they often do.

One of the best lessons my father taught me was that “If you don’t start giving when the dollars are small, you’ll be even less likely to give when the dollars are bigger.” But the amazing—and truly confounding—thing about giving is that the benefits aren’t only for those who would label themselves “charitable” or “philanthropic,” and giving also tends to benefit the giver, just as it does the recipient.

Dr. Daniel Crosby even goes so far as to suggest that “Giving Is The Path To Abundance.”

LIVE

Common Assumption: “Save now, live later.”

Supporting Biases: Thanks to the present bias and our tendency toward hyperbolic discounting, we tend to discount the future heavily while paradoxically also deferring joy to “someday.”

Some of the most prominent voices in personal finance sound like a broken record, elevating deferred gratification to one of the 10 Commandments. And while it’s absolutely true that we must discipline ourselves to invest in our future sustenance early and often, we must balance our dedication with another truism: Tomorrow is promised for none of us, and enjoyment in the present is no less of a moral imperative than saving for the future.

Conclusion

Everything within us prefers to be right. However, if you’re willing to name, flip, and test your assumptions, you’ll probably find yourself wrong more often than you’d like. But that’s also how we learn, and it’s how wealth—financial and otherwise—really grows.

Net Worthwhile® Podcast

The Human Side Of Money

This week’s podcast isn’t actually an official NWWW episode; instead, I had the privilege to be a guest on one of my favorite advisor-oriented podcasts, hosted by Brendan Frazier called, The Human Side Of Money.

Click HERE to listen to the episode.

Quote O' The Week

Friedrich Nietzsche (1844–1900) was a German philosopher and former professor of classical philology, whose radical critiques of truth and morality reshaped modern thought; after collapsing from a mental breakdown in 1889, he lived his final years incapacitated before dying in 1900 from complications likely related to a stroke and pneumonia.

Weekly Market Update

Markets were mostly up this week, and Tony will update us on what’s happening below:

+ 1.59% .SPX (500 U.S. large companies)

+ 0.52% IWD (U.S. large value companies)

+ 0.24% IWM (U.S. small companies)

- 0.26% IWN (U.S. small value companies)

+ 1.04% EFV (International value companies)

+ 1.40% SCZ (International small companies)

+ 0.00% VGIT (U.S. intermediate-term Treasury bonds

Disinflation Intact…For Now

Contributed by Tony Welch, CFA®, CFP®, CMT, Chief Investment Officer, SignatureFD

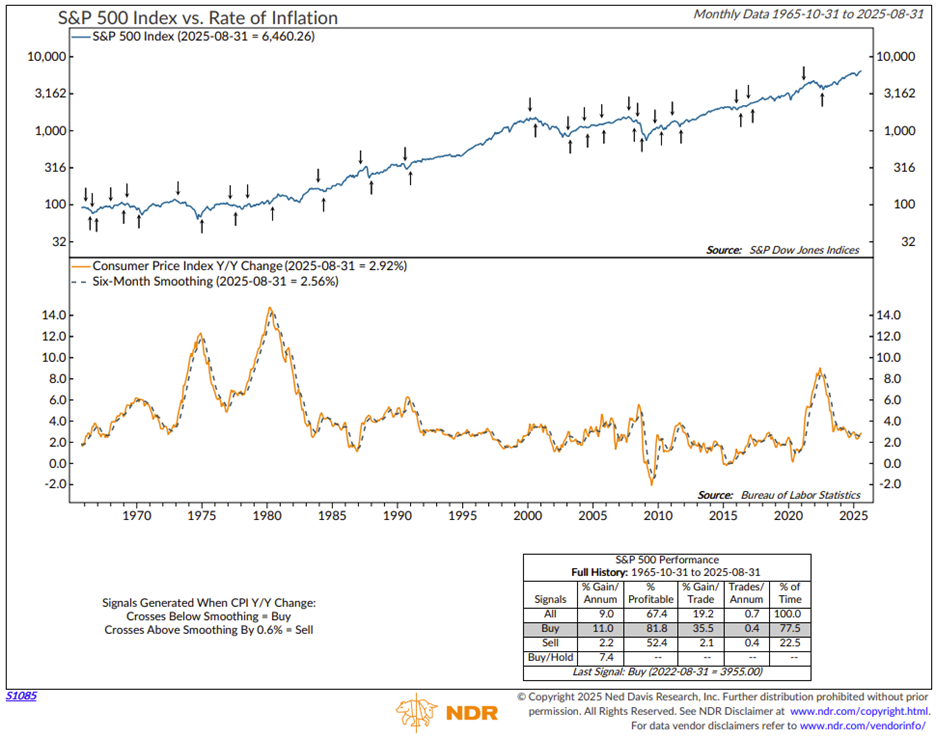

Perhaps no chart describes the bull market which began in September 2022 better than the chart we’re featuring this week. Inflation had peaked and began to turn lower, generating a “buy” signal for the stock market only one month before the market bottomed.

We can see in the chart below that when inflation is below its average level from the past six months, stocks have performed quite well, gaining 11% per annum, before we account for dividends. We can also see that the latest inflation report, showing 2.9% inflation, is now higher than the past six-month average of about 2.6%. The chart suggests that when inflation rises by 0.6 percentage points above its six-month average, stocks have tended to struggle. With the last update, we’re about halfway there.

Rising inflation would not necessarily be a death knell to the bull market but consider that “sell” signals have been correct 52% of the time, implying that if inflation were to break out, it would become a headwind for stocks, rather than the disinflationary wave that has been largely present since Fall 2022…something to watch.

Chart O’ The Week

The Message from Our Indicators

Last week gave us a fresh view on the labor market, consumer sentiment, and inflation. Labor market conditions continue to soften, with employment trend indices pointing to growing slack and small business surveys reflecting weaker hiring intentions. At the same time, producer prices unexpectedly declined but not necessarily for a great reason. Trade margins eased, suggesting that producers have been absorbing input inflation. But consumer prices still rose at their fastest pace since January, led by sticky services and shelter inflation.

Despite these crosscurrents, the Federal Reserve is widely expected to begin a new easing cycle next week, with markets pricing three cuts by year-end. Globally, central banks are already in easing mode, and the Fed’s relatively more aggressive stance could put downward pressure on the dollar.

The University of Michigan’s preliminary September survey showed consumer sentiment easing modestly, with concerns about business conditions, labor markets, and inflation weighing on expectations. Sentiment is still above the trough levels seen in April and May but remains well below year-ago readings. A potential government shutdown at the end of September also adds to policy uncertainty.

Corporate fundamentals remain a mixed picture. Small business earnings trends are improving, and expectations for sales have brightened. However, revisions to payroll data revealed that job growth has been weaker than previously thought, underscoring the labor market’s fragility. Meanwhile, valuations remain elevated. By almost any measure, U.S. stocks are expensive relative to history, with forward price-to-earnings ratios near levels seen during prior bubble periods. Much of the market’s earnings outlook depends on promised productivity and margin gains from artificial intelligence, leaving investors dependent on a favorable fundamental story playing out, which has thus far been the case.

From a technical perspective, markets have continued a cyclical bull trend. Short-term momentum indicators have weakened, in line with typical seasonal September softness, but longer-term breadth signals still point toward the potential for a year-end rally. Investor sentiment has rebounded from the pessimism earlier this year but has yet to reach euphoric levels; another wave of optimism later this year could introduce more risk. Sector leadership has also begun to rotate, with cyclicals showing relative strength, though history suggests that the path of Fed easing will be critical in determining whether that rotation is sustained. Elevated valuations mean there is less margin for error, but with inflation contained enough to allow for policy support, the balance of evidence remains constructive while acknowledging the risks ahead.

Nope, I’m still not ready to talk about the Ravens loss to the Bills last Sunday. Not sure I’ll ever be, but let’s not let any of this weekend’s spectator sports spoil our Sunday!

Tim