People Want To Live Their Money, Not Just Accumulate It

And This AI-Based App Aims To Help Them

“People want to live their money,” Pete Dorsey, financial industry veteran and co-founder of the new AI-based financial planning and investment app, Wing, told me. “They don’t want to just accumulate over time.”

No, they don’t, and that’s inconvenient, considering that perpetual accumulation has been the financial industry’s model for at least a hundred years.

Let’s face it, the financial industry doesn’t profit from helping people spend their money, but by helping them pile it up. And that’s a shame, because the emotional benefits of accumulation pale in comparison to the joy of intentional living, spending, and giving.

Yet, the fact remains that we do need to accumulate, grow, and protect our assets to fund our spending, however intentional, throughout life. So, perhaps Dorsey (and Wing) is onto something.

This week, I’ll unroll Pete’s thoughts in our Financial LIFE Planning section before sharing the interview we did via the NWWW Podcast. Then Tony is “Bringing Back The ‘T’ Word” in his Weekly Market Update.

Tim

Tim Maurer, CFP®, RLP®

Chief Advisory Officer

In this Net Worthwhile® Weekly you'll find:

Financial LIFE Planning:

People Want To Live Their Money, Not Just Accumulate It

NWWW Podcast:

How AI Is Redefining Financial Planning With Pete Dorsey Of Wing

Quote O' The Week:

Margaret Bonanno

Weekly Market Update:

Bringing Back The “T” Word

Financial LIFE Planning

People Want To Live Their Money, Not Just Accumulate It

The Financial Establishment’s Condescension Problem

The financial establishment’s problem starts with our choice of morning beverage, how and where it’s prepared. You’ve certainly received the admonition, implicitly or explicitly, that it’s wasteful to spend $5 to $9 for a coffee or latte or other caffeinated confection when you could simply prepare a similar substitute for pennies on the dollar at home, right?

You’ve also likely heard that you’re among the financially irresponsible if you have a car payment, if your mortgage extends longer than 15 years, or you put less than 20% down on your house, right? But alas, Dave Ramsey’s Total Money Makeover was not divinely delivered via stone tablets on Mount Sinai (and, as it turns out, calling people stupid isn’t the most evolved form of motivation).

The judgement that begins with the financial literacy crowd often doesn’t stop with financial wellness, financial planning, or wealth management, as too often the playbook is merely someone else’s idea of what should be most important to you—rather than a process to help you identify that for yourself and a plan to help you fund it.

Perhaps that’s why Ramsey’s rumored recidivism rate is shockingly high, and studies suggest that as many as 70% to 80% of financial planning recommendations go unimplemented! It’s almost as though financial planning is too often upside down; it starts with someone else’s compulsion rather than your impulsion.

Full disclosure: My firm, Signature FD, is one of Wing’s early partners, a decision we made because we believe quality financial advice shouldn’t be the exclusive domain of those with seven-figure portfolios. If technology can help us serve the people who need advice most—not just those who can most easily afford it—that’s an investment worth making.

The Retirement Myth We’re All Living

Perhaps one of the reasons this is so common is that financial planning has long been all too retirement-centric. Pete and I considered the possibility that retirement was an idea manufactured for a single generation, the Baby Boomers. After all, generations prior pretty much worked until they couldn’t, and subsisted off of Social Security supplemented by modest savings for a relatively short retirement.

Boomers, on the other hand, made outearning their parents the goal (which they achieved), but too many cornered themselves into jobs they didn’t love in pursuit of a utopian retirement that often didn’t materialize.

Gen X mostly followed that plan, but younger generations have a more morbid view of retirement and are asking more of their work. Money isn’t meaningful enough for them.

The Longevity Wildcard

And that’s ok, because younger generations are likely right to question the norms on working, saving, spending, and living—because they could be living a long time. Dorsey posited, instead of saving for a 10- or 20-year retirement, “how do you plan for a 60-year retirement?”

Perhaps it’s about reimagining the entire relationship between work and life and considering the possibility that learning to “live your money” is an essential skill, not optional.

What Money Actually Represents

Pete Dorsey’s paradox is that money is “priceless and worthless at the same time.” It’s hard to argue literally, as those of us (which is roughly everyone) who use fiat currency are using paper, cards, and online digits that are only worth what everybody else is willing to believe they’re worth. Yet it both runs the world (and our worlds) and carries a very heavy emotional weight with it.

Dorsey referenced a conversation he had with a couple, examining a net worth statement well into seven figures, but the wife was in tears because of the husband’s constant monitoring of every dollar spent. All she wanted to do was shop at Trader Joe’s without fierce examination of every price tag.

“The days of generic one-size-fits-all advice are being replaced,” Dorsey suggests, “by deeply personalized advice that is rooted in people’s relationship with money, their risk tolerance, their aspirations, and their evolving circumstances.”

He insists that this requires “hyper-personalized advice,” that is simultaneously his chief counsel to human financial advisors—to up their EQ game, as so much of the quantitative aspects of financial planning are fast becoming commoditized—and his aspirations for Wing’s AI-assisted platform.

They seek to accomplish this, in part, with a new spin on the notion of goals that the app refers to as “Experiences.” And yes, while you’ll find experiences like “Securing My Retirement” and “Investing My Money,” you’ll also find “Traveling The World,” “Taking A Sabbatical,” and even “Living Like A Nomad,” with more Experiences regularly being added.

The key shift, Pete Dorsey suggests, is that this is a client-led financial plan—not an advisor telling you what you should want.

The Path Forward

The fundamental shift from “Can I afford this?” to “Is this worth trading for something else?” requires both structural support and personal honesty. This means:

An honest assessment of what truly matters to you

Visibility into all your financial accounts

Willingness to prioritize some experiences over others

Understanding that trade-offs are real: You can do anything, but you can’t do everything

A regular refresh as life and financial circumstances evolve

The financial industry is slowly, if not grudgingly, learning that accumulation without purpose is just hoarding with a better marketing budget. The future belongs to advice—whether delivered by humans, AI, or likely a hybrid—that helps people live richly at every stage of life, not just in some mythical retirement that may never come, or may last four decades or more. This is, I believe, because people want to live their money. And perhaps, finally, the industry is ready to help them do exactly that.

This post was initially published on Forbes.com.

NWWW Podcast

Quote O' The Week

Margaret Wander Bonanno (1950-2021) was an American science-fiction author best known for her tie-in novels in the Star Trek universe and her original trilogies The Others and Preternatural.

Weekly Market Update

Everything—or, at least, the indices we track to provide a broad market perspective—were up this week:

+ 1.70% .SPX (500 U.S. large companies)

+ 1.70% IWD (U.S. large value companies)

+ 2.36% IWM (U.S. small companies)

+ 2.43% IWN (U.S. small value companies)

+ 2.05% EFV (International value companies)

+ 1.60% SCZ (International small companies)

+ 0.37% VGIT (U.S. intermediate-term Treasury bonds

Bringing Back The “T” Word

Contributed by Tony Welch, CFA®, CFP®, CMT, Chief Investment Officer, SignatureFD

Economic professionals try to make predictions about a future that contains an infinite number of possibilities. So, they may be excused somewhat for predicting that the 2022 inflation would be transitory. The consensus of forecasts projected a one-time burst in inflation that would fade. They took a lot of heat when inflation remained elevated and, at 2.9%, is still above the Fed’s target of 2% to this day.

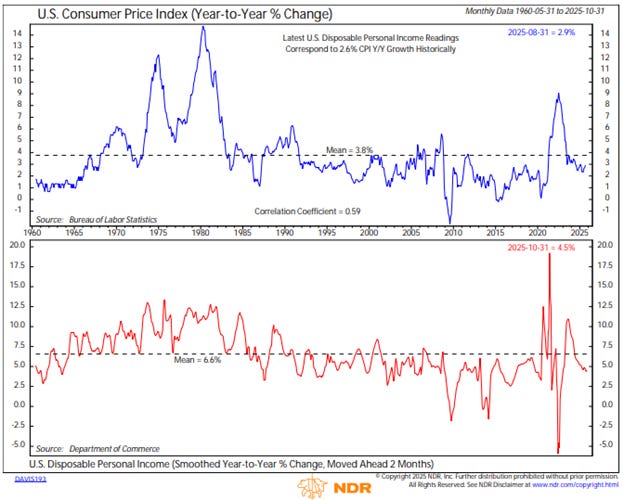

The blue line in the top clip of the chart below shows the inflation rate through time. And quite frankly, I’m not sure economists deserved the backlash. Inflation peaked and fell steadily. And after all, though the Fed may target 2%, inflation has actually averaged 3.8%. So, inflation is below the historical average, and it sure does look like that 2022 inflation was in fact transitory.

But what about the stall in inflation’s downtrend recently? Trade policy has put some upward pressure on inflation in the near-term, but I believe this, too, is more likely to be temporary. Why? Because the labor market simply cannot support a breakout of inflation at this time. The red line in the bottom clip shows the change in disposable income. The change in income has a solid correlation with inflation and incomes are currently sluggish. Income is growing 4.5%, which is below the average of 6.6%.

The latest reading has historically corresponded with 2.6% inflation, still higher than target but manageable. Inflation was the primary market driver a few years back, but that isn’t the case today. I expect stable inflation is likely to give the Fed confidence that they can ease policy more, and in fact, the weakness in incomes suggests that a more supportive policy mix may even be necessary.

Chart O’ The Week

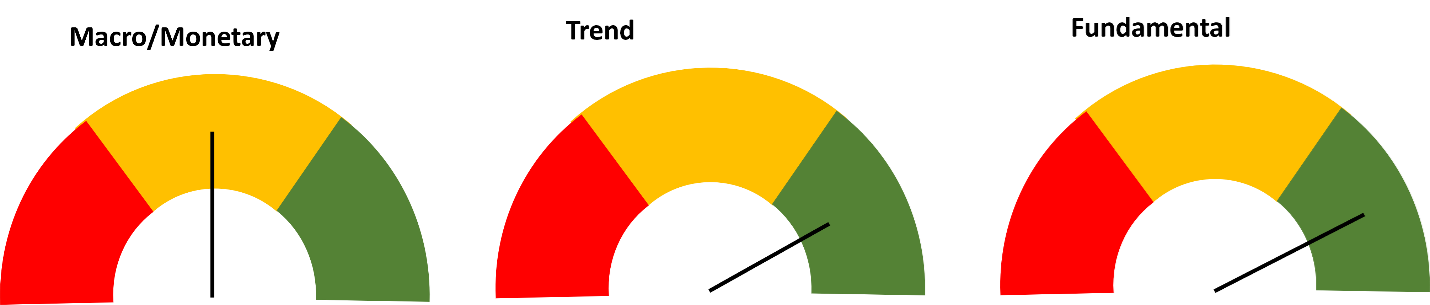

The Message from Our Indicators

Recent data suggest a mixed but generally stable economic backdrop as the U.S. enters the final stretch of 2025. Small business sentiment softened in September as owners grew more cautious about sales and expansion prospects, and freight activity remains subdued, hinting that trade disruptions and tariffs are still weighing on goods movement and cost pressures. Even so, forward-looking housing indicators improved, with homebuilder sentiment climbing to a six-month high, helped by the recent decline in mortgage rates. Inflation continues to trend lower overall, but pressures remain uneven. Input costs in transportation and housing are still elevated, and smaller firms continue to cite higher prices as a major concern.

More broadly, the macro environment appears to be finding better balance across what Ned Davis Research calls the “three I’s” — inflation, interest rates, and (il)liquidity. Inflation has shifted from a clear headwind to a more neutral influence, long-term interest rates are trending down, and money supply conditions remain broadly supportive. Together, these trends have historically been a tailwind for stocks, though high valuations and lingering liquidity risks argue for a balanced approach.

Third-quarter earnings season is off to a solid start, providing another stabilizing force for markets. Early results from major banks and industrials indicate better-than-expected revenue growth, while margins have largely held near record levels. Technology remains the dominant earnings engine, expected to contribute more than half of S&P 500 profit growth this quarter, led by continued strength in AI-related spending.

The so-called “Mag 7” still accounts for an outsized share of profit expansion, but the earnings recovery is beginning to broaden beyond mega-caps, a constructive sign for market breadth heading into year-end. Valuations, however, remain elevated. The market trades near levels last seen around the tech bubble and post-pandemic stimulus peaks. Yet relative to corporate bonds, equities still appear reasonably priced. In short, the market looks expensive but not extreme, and continued earnings growth could help valuations normalize over time.

Equities continue to consolidate following one of the strongest six-month rallies in modern history, a roughly 35% advance off the post-tariff lows this spring. Historically, similar surges have been followed by slower but still positive gains, a pattern consistent with what we’ve seen so far in October. While short-term momentum has cooled and some measures of market breadth have softened, most long-term trend indicators remain constructive. At a higher level, the secular bull market that began in 2009 remains intact. Most long-term indicators still favor equities, even as fiscal strain and weakening global leadership have pushed gold higher and the dollar lower. Historically, that mix, rising precious metals and a declining dollar, has signaled late-cycle conditions but not necessarily a market top.

Overall, economic momentum is moderating but remains resilient. Inflation is easing, corporate profits are broadly healthy, and long-term interest rates are trending down, all of which argue for maintaining balanced risk exposure. While valuations and sentiment leave less margin for error, we believe the weight of the evidence continues to favor staying invested, with an eye toward quality, cash-flow stability, and disciplined rebalancing through year-end.

Have a great, fall weekend, friends!

Tim