Scottie Sheffler Shares Solomonic Wisdom That We Can All Apply In Life And Money

“I love the challenge … it’s one of the greatest joys of my life, but does it fill the deepest wants and desires of my heart? Absolutely not.”

That was the killer quote from a recent interview with the world’s number one golfer, Scottie Scheffler, that went viral this week. And I think this one went viral for a reason: It taps into a universal truth or two about humanity that we know at a subconscious level, but that rarely shines through the manic malaise of our achievement-oriented culture.

This week, we highlight how Sheffler’s wisdom has a connective thread back through, oh, a few thousand years of wisdom literature, and we’ll explore how we can apply that wisdom in life, work, and money.

Tony and I also chat about a counter-intuitive approach to investing in retirement on this week’s podcast, before he breaks down the market happenings in this week’s Weekly Market Update.

Thanks for joining us!

Tim

Tim Maurer, CFP®, RLP®

Chief Advisory Officer

In this Net Worthwhile® Weekly you'll find:

Financial LIFE Planning:

Scottie Sheffler Shares Solomonic Wisdom

NWWW Podcast:

Does Risk Tolerance Really Decline With Age?

Quote O' The Week:

Ingrid Bergman

Weekly Market Update:

Looking Differently At Risk In Investing

Financial LIFE Planning

Scottie Sheffler Shares Solomonic Wisdom

“It feels like you work your whole life to celebrate winning a tournament for a few minutes – it only lasts a few minutes, that euphoric feeling,” Sheffler further explained. “You win it, you celebrate, get to hug my family, my sister’s there, it’s such an amazing moment. Then it’s like, ‘OK, what are we going to eat for dinner?’ You know, life goes on.”

While his language is a touch more approachable, Sheffler is practically quoting ancient wisdom literature attributed to the world’s then (in the 10th century, BC) number one, King Solomon, in Ecclesiastes:

“Then I considered all that my hands had done… and behold, all was vanity and a striving after wind, and there was nothing to be gained under the sun.”

Interestingly enough, that fading feeling is explained in the field of behavioral economics through the term “hedonic adaptation.” This theory notes that we, as humans, can marshal an enormous amount of energy to achieve certain goals, only to experience a pretty rapid dilution of the intensity felt in peak moments.

The Upside Of The “Hedonic Treadmill”

And that’s not necessarily a bad thing, right? I mean, think about this for a second. What if you only ever achieved your first goal and stayed satisfied with it forever?

We wouldn’t have made it out of middle or high school! You’d still be stuck in your first job. We’d only have Yo‑Yo Ma’s Simple Gifts to enjoy—possibly fully satisfying, if he hadn’t later collaborated with Alison Krauss. And we wouldn’t even know the name Scottie Sheffler, because he would’ve stopped after breaking 100 on his home course, or maybe shooting under par for the first time.

Yes, on the one hand, perpetually chasing the next shiny achievement can, and often does, lead to an insatiable spirit of striving that can land us with a full resume but an empty life. But there is a healthier version of this narrative that can fully appreciate a desired outcome and still propel us forward to the next.

The other upside of hedonic adaptation is that it doesn’t just apply to the good and great things we experience, but also to the bad and even horrible. Yes, humans are designed to bounce back pretty quickly, and that, too, is explained by hedonic adaptation.

So, What Truly Satisfies?

So, if being the very best in the world at something doesn’t provide lasting satisfaction, what does? Here again, Scottie seems to be channeling ancient wisdom. Solomon advised, “Enjoy life with the wife whom you love all the days of your fleeting life… For this is your portion in life…” while Sheffler similarly signals the deeper fulfillment found in his family, even suggesting that it is the service of his family that adds meaning to his work as a professional golfer:

“Every day when I wake up early to go put in the work, my wife thanks me for going out and working so hard. When I get home, I try and thank her every day for taking care of our son.… I’d much rather be a great father than I would be a great golfer. At the end of the day, that’s what’s more important to me.”

Personally, I believe that it would be an oversimplification to suggest that the only avenue in life for genuine fulfillment is family. It may be Sheffler’s (and it is a very big part of mine), but not everyone has a spouse, partner, or children. And some people do derive a significant amount of satisfaction from their work.

I believe that Arthur Brooks, social scientist, Harvard professor, and best-selling author—may summarize it best: “Money, power, pleasure, and fame won’t make you happy. Faith, family, friends, and meaningful work will.”

Scottie Scheffler’s raw revelation—“This is not a fulfilling life…I’d much rather be a great father than a great golfer”—reveals the distance between short-lived triumphs and enduring satisfaction. Like Solomon’s “vanity… a striving after wind,” and like the rapid fade of joy described by modern psychology as hedonic adaptation, these highs—even the mountaintop moments—don’t fill the soul for long.

What Can We Do?

So, what ways can we navigate success and failure to suit the science and nudge us ever further to lasting joy?

Pause after wins and take time to recover after losses. There is still enjoyment to be experienced and pain to be processed. How long it lasts depends on our psyche and the situation. But by all means, let’s not rush through these momentous occasions.

Consider Brooks’ framework—“faith, family, friends, and meaningful work”—and rate yourself on your areas of strength and weakness.

Take one step in the direction of your discernment. It could be as simple as leaving a surprise note for your spouse, taking your daughter on a date, exploring moments of meaning in your work, or grounding your life within a worldview or faith journey that is calling.

Scheffler’s confessions—wrapped in ancient wisdom and modern psychology—are not an argument against ambition, but an invitation: Let our victories move us forward, not define us. And let our lasting fulfillment be found in the people we love, the grief we overcome, and the service we offer.

NWWW Podcast

Quote O' The Week

Ingrid Bergman (1915–1982) was a celebrated Swedish actress whose natural charm and emotional depth made her one of classic Hollywood’s most revered stars, known for roles in Casablanca and Notorious.

Ingrid Bergman

“Happiness consists of a solid faith, good health, and a bad memory.”

Weekly Market Update

Markets had mixed feelings this week:

+ 0.59% .SPX (500 U.S. large companies)

- 0.21% IWD (U.S. large value companies)

+ 0.28% IWM (U.S. small companies)

- 0.98% IWN (U.S. small value companies)

- 0.85% EFV (International value companies)

- 0.12% SCZ (International small companies)

+ 0.14% VGIT (U.S. intermediate-term Treasury bonds

Are We Looking At Risk Wrong?

Contributed by Tony Welch, CFA®, CFP®, CMT, Chief Investment Officer, SignatureFD

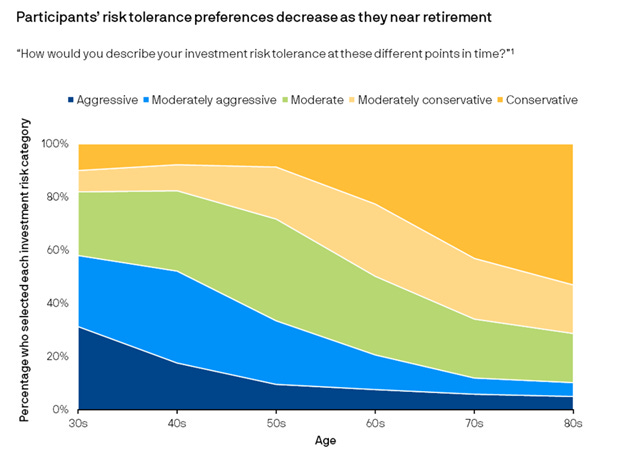

JP Morgan surveyed retirement plan participants, asking them about their perceived risk tolerance in each decade of life. The results are shown in the chart below. We can see that beginning in their 50s, respondents become less tolerant of risk in each successive decade. A good question might be – should they? Maybe not.

We know that sequence of returns is a major risk in retirement. If portfolios draw down significantly early on, it can be devastating to achieving one’s retirement goals. So, taking a more conservative stance in your 60s is likely appropriate. But what about in your 70s, 80s, or 90s? Having made it through those early retirement years, many investors may be able to begin layering in more risk into those later decades. That’s because excess capital is now likely to outlive you and your spouse and be passed on to future generations. Now we’re talking about the longer timeline of your kids or maybe even grandkids.

We believe the dark yellow in the chart below should probably resemble a “U,” where investors are near their most conservative early in retirement and then become more aggressive again in later decades.

Chart O’ The Week

The Message from Our Indicators

The impact of tariffs on inflation was in focus last week. On the surface, price pressures remain relatively tame, but there are crosscurrents building just below the headline numbers, many of which are tied to the evolving tariff environment. June’s CPI and PPI reports were largely in line with expectations. Core CPI rose 0.2% month-over-month (2.9% y/y), while producer price inflation eased to 2.4% y/y. But signs of tariff-induced pressures are emerging. Goods inflation is reaccelerating. Apparel, household furnishings, and recreational goods all saw price increases, while services inflation is moderating due to cooling rents and airfare declines.

This split dynamic, where rising goods prices are offset by easing services inflation, has kept overall inflation steady for now. However, the disinflationary tailwinds of the past cycle may be fading. The inflation backdrop remains manageable, which we expect is likely an important factor for the stock market in the months ahead.

Ned Davis Research (NDR) took a deep look at the employment market last week. Initial jobless claims have fallen to a three-month low, and retail sales surprised to the upside in June, hinting at durable consumer strength. But the internals of the labor market tell a different story. June’s household employment data showed only 93,000 jobs added. Meanwhile, labor force participation among young workers (ages 16–24) experienced its second-largest non-pandemic decline since the 1950s, and discouraged workers increased by a record amount. Participation among older and foreign-born workers also continues to decline. The falling unemployment rate is not due to increased hiring; it’s due to fewer people looking for work, an important distinction.

With underlying inflation pressures rising and the labor market weakening in a non-obvious way, the Fed finds itself navigating a narrow path. Strategas Research Partners believes the Fed remains in a rate-cut cycle but is waiting for clearer evidence that inflation expectations will remain anchored despite tariff-driven volatility. September remains the first “live” meeting for a rate cut.

From a technical perspective, bull market participation has been solid but not spectacular. Stock prices have historically corrected in Q3 of the first year of a presidential term. Market sentiment has swung from deep pessimism in early April to optimism now. We expect some pick-up in volatility in the months ahead, but as long as earnings continue to grow, bear market risk is likely to remain low. All told, the economy is softening and there is some inflation pressure on goods prices. But both conditions could be manageable, and we believe the bull market remains intact.

Thanks for reading this week! Next week, you won’t be getting a NWWW post as its Editor In Chief will be on vacation. :-)

Tim

Great points on hedonic adaptation.