Self-Forgetfulness: George Kinder’s Key To Finding—And Being—A True Fiduciary

Sitting at a kitchen table, George Kinder asked a question of a young woman. Her response opened the door to a decision that could genuinely transform her life. She might reconsider having kids after all.

George Kinder has helped transform the world of financial planning without a single quantitative calculation, focusing instead on finding the right questions. His legendary 3 Questions exercise has helped many connect meaning to money, but now he’s asking even bigger questions, and he’s asking them of institutions as well as individuals.

I had a chance to interview George recently, and our conversation (shared here as this week’s NWWW Podcast) is the inspiration for this week’s Financial LIFE Planning section—featuring a lesser-known term that George plants at the center of the fiduciary conversation: self-forgetfulness.

And in addition to his regular Weekly Market Update, Tony includes a chart with a powerful illustration making The Case For A “Bucketed” Portfolio Design.

Tim

Tim Maurer, CFP®, RLP®

Chief Advisory Officer

In this Net Worthwhile® Weekly you'll find:

Financial LIFE Planning:

Finding—And Being—A True Fiduciary Through Self-Forgetfulness

NWWW Podcast:

George Kinder’s Vision For A Fiduciary Society

Quote O' The Week:

Mother Theresa

Weekly Market Update:

The Case For A “Bucketed” Portfolio Design

Financial LIFE Planning

Finding—And Being—A True Fiduciary Through Self-Forgetfulness

I recently had an opportunity to speak with George about his FIAT (Fiduciary In All Things) initiative, which wonders what the world would look like if the fiduciary requirement for financial advisors, to put their clients’ interests ahead of their own, had universal adoption beyond the domain of wealth management.

And whether Kinder’s questions are destined to change the world or not, they are certainly extending their reach beyond financial planning and into companies (especially B corps) and industries that may be considering the F-word (fiduciary) and its application for the first time.

Yet at the tail end of our conversation, an insight emerged that wasn’t an intentional part of our interview, but that may just be the key to finding—and being—a true fiduciary. It’s the counterintuitive, countercultural notion of self-forgetfulness, and it’s my goal to help you understand its application, both as a financial advisor and as a client in search of (a better) one.

Being A True Fiduciary

The letter of the law requires true financial advisors, beholden to the Investment Advisers Act of 1940, to put the best interest of the client ahead of their own, as fiduciaries. This was deemed a necessity after the dust settled from the Great Depression, but considering that financial advisors are still deemed one of the least trustworthy of all professionals in the 2020s, methinks we need to revisit the spirit of the law behind this 18-point Scrabble word—fiduciary.

For too many, the fiduciary duty has turned into a regulatory box to be checked—like, we could defend this particular recommendation in a court of law—and that’s unfortunate, because it’s the deeper essence of this word that opens a door to a new level of interaction between advisor and client.

You see, fiduciary isn’t just legal compliance; it’s practiced self-forgetfulness. As an advisor, this means you’re not thinking about yourself, your ego, your AUM, your commission, or anybody else’s perception of your work in that moment. You’re just thinking about the client.

This leads to a multidimensional approach to listening and learning, a skill that Kinder notes is a virtual superpower relative to cognition slowed by the effort of thought. (This is one of the reasons, by the way, that Kinder rarely takes notes in a client’s presence, because he wants to be fully present.)

And while the notion of self-forgetfulness might seem anathema in 2025’s it’s-all-about-you twist on self-improvement, this notion has long been the domain of some of the world’s great thinkers:

Psychiatrist and Holocaust survivor, Viktor Frankl, gently bursts the bubble of all short-form life coaches with this mic drop line: “You actualize yourself precisely to the amount to which you don’t concentrate on self-actualization. You forget yourself. You give yourself to the task at hand.”

Mihaly Csikszentmihalyi, the psychologist and originator of Flow Theory, adds fuel to the fire with his paradoxical finding that “the self expands through acts of self forgetfulness.”

The ever-quotable C. S. Lewis wrote that “humility is self-forgetfulness,” and I love pastor and author Tim Keller’s artful paraphrase of Lewis, suggesting that the essence of “humility is not thinking more of myself or thinking less of myself, it is thinking of myself less.”

Please note, advisor friends, that self-forgetfulness in client practice is not necessarily natural; it may not satisfy the desire for short-term profit, and will almost never be counted in your favor in a performance review.

BUT.

When self-forgetfulness becomes institutionalized—when it’s not just you on your best day, but the ethos of your entire practice—something remarkable happens. Clients begin to sense it, and this is when trust compounds. This trust may not be measured in assets under management (initially), but it’s the kind that builds careers, transforms lives, and yes, eventually shows up in your business metrics.

What does (and doesn’t) it actually look like in practice? C. S. Lewis wrote that a truly humble person won’t be “greasy” or “smarmy,” constantly telling you he’s nobody. Rather, he’ll seem like “a cheerful, intelligent chap who took a real interest in what you said to him. He will not be thinking about humility: he will not be thinking about himself at all.”

This is the financial advisor as true fiduciary—not performative humility, but practicing self-forgetfulness.

Finding A True Fiduciary

But here’s where it gets really interesting. When advisors practice self-forgetfulness, they create the space for clients to do the same. And this, friends, is when financial planning becomes financial life planning.

When clients get beyond the intellectual belief that you’re a letter-of-the-law fiduciary and experience your self-forgetful presence, it frees them from the need to look smart, the impulse to defend themselves, the fear of judgment, and, perhaps most importantly, it inspires a more expansive canvas upon which to engage in human-first financial planning.

It’s when questions evolve from “Can I afford to retire?” to “What would I do if money were no issue?”

And what are the signs that you may have found a self-forgetful fiduciary?

She listens at least twice as much as she talks.

He seems more enamored with your problems than his solutions.

They are unhurried.

They’re comfortable with silence, not rushing to fill the space with their expertise.

You leave meetings feeling energized rather than educated.

They remember the details of your life—not just your portfolio.

When you achieve something meaningful, they celebrate without taking credit.

The Liberation Principle

As Kinder reminded me in our conversation, “You can’t meet the moment without forgetting yourself. It’s a prerequisite.”

So, whether you’re an advisor trying to serve clients more deeply, or a client searching for someone who truly puts your interests first, self-forgetfulness is the litmus test.

The Investment Advisers Act of 1940 gave us the legal framework. But it’s the spirit behind the law—the practiced art of self-forgetfulness—that transforms fiduciary duty from regulatory compliance into something that can change lives.

The aim, Kinder suggests, is “liberation, not accumulation.” This is beyond textbook financial planning, and it’s more than mere “financial independence.” Personally, I believe it’s the ultimate end goal of the work we do in wealth management, and as we observe the rapid commoditization of most of the calculative aspects of the work we do, I’m optimistic that the future of advisory work may finally satisfy the aspirations of its 1940 founders.

This post was initially published on Forbes.com.

NWWW Podcast

Quote O' The Week

Mother Teresa (1910-1997), born Anjezë Gonxhe Bojaxhiu in Macedonia, left home at age 18 to become a missionary and never saw her mother or sister again for the remaining 69 years of her life. When she first arrived in India, she had no income and was forced to beg for food on the streets—an experience that gave her firsthand understanding of the suffering she would dedicate her life to alleviating.

Weekly Market Update

Large cap growth was up this week. Everything else, uh, down.:

+ 0.71% .SPX (500 U.S. large companies)

- 0.84% IWD (U.S. large value companies)

- 1.28% IWM (U.S. small companies)

- 2.41% IWN (U.S. small value companies)

- 0.10% EFV (International value companies)

- 1.61% SCZ (International small companies)

- 0.45% VGIT (U.S. intermediate-term Treasury bonds

The Case For A “Bucketed” Portfolio Design

Contributed by Tony Welch, CFA®, CFP®, CMT, Chief Investment Officer, SignatureFD

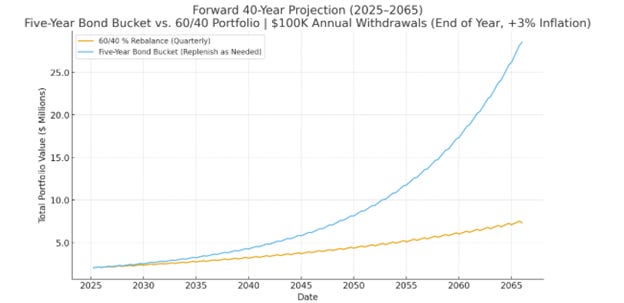

This week’s chart* compares two ways of managing a retirement portfolio: a traditional 60/40 allocation, rebalanced quarterly, and a bucketing approach that holds five years of planned withdrawals in bonds and keeps the rest in equities. Both portfolios start with $2 million, earn long-term average returns of 10.3% for stocks and 4.8% for bonds, and fund $100,000 of annual withdrawals adjusted for inflation. Over forty years, the bucketed portfolio produced a substantially higher ending value, nearly $28 million versus $7 million, because the stock portion was allowed to compound uninterrupted for long stretches while short-term cash needs were met from the bond reserve.

This demonstrates a key advantage of time-segmentation strategies: by isolating near-term spending needs, investors can leave their long-term growth assets untouched during market noise. The result is a smoother behavioral experience, retirees are not forced to sell stocks at inopportune times, and more of their capital remains exposed to compounding over full market cycles. In essence, the bond “bucket” acts as a psychological and financial shock absorber, allowing the growth sleeve to do its job.

That said, a bucketed approach is not a free lunch. Over time, as equities appreciate and the bond bucket is periodically refilled, the portfolio’s equity exposure naturally rises, introducing more volatility than a static 60/40 mix. In practice, investors must be comfortable with this variability and prepared to rebalance opportunistically if equity valuations or spending needs change. Still, the underlying message is powerful: aligning portfolio structure with time horizon, rather than fixed percentages, can improve both long-term outcomes and investor confidence through the ups and downs of the market cycle.*

Chart O’ The Week

The Message from Our Indicators

Economic conditions continue to show resilience despite the prolonged government shutdown, which has delayed many key data releases. Alternative indicators suggest that activity remains solid. The Dallas Fed’s Weekly Economic Index and private sector data both point to GDP growth near 2–2.5% in the fourth quarter, consistent with a soft-landing scenario rather than an outright slowdown. Consumer confidence has softened modestly but remains consistent with continued expansion, and regional manufacturing surveys show stabilization in new orders and employment. Inflation data released through the September CPI confirmed that price pressures are moderating outside of tariff-related distortions, while shelter costs continue to ease and services inflation remains sticky but trending lower.

Against this backdrop, the Federal Reserve delivered its fifth rate cut of the cycle, lowering the fed funds target range to 3.75–4.00% and announcing that quantitative tightening will end on December 1. Chair Powell acknowledged “strongly differing views” among FOMC members about a December cut, signaling that further easing is possible but not guaranteed. Policy uncertainty aside, liquidity conditions are improving as the Fed pivots from draining reserves to reinvesting maturing MBS into Treasury bills, effectively another form of easing. While the Fed’s cumulative 150 basis points of cuts represent only about a quarter of its prior tightening cycle, the direction of travel remains toward normalization, with easier financial conditions supporting risk assets.

On the fundamentals front, corporate earnings are once again surprising to the upside. Roughly a third of S&P 500 companies have reported third-quarter results, with 85% exceeding expectations, a near-record pace. Management commentary across sectors shows little concern about economic slowdown; mentions of layoffs remain below pre-pandemic levels and AI-related investment continues to expand, providing a bridge to stronger capital spending into early 2026. Consensus estimates for fourth-quarter earnings have barely budged, with operating EPS growth still tracking around 13%, suggesting the profit cycle remains in an expansionary phase.

From a market trend perspective, the weight of the evidence continues to support the ongoing bull market. Financial conditions are among the loosest since early 2022, leading indicators remain above trend, and both the S&P Global Composite PMI and policy composite indices indicate economic momentum consistent with further equity strength. Inflation expectations remain well anchored near 2.3%, underscoring confidence that moderate inflation can coexist with economic growth. While some technical divergences are emerging, leadership continues to broaden beyond large-cap technology as AI capital spending diffuses across industries.

All told, the macro and market indicators still lean supportive. Inflation is falling for the right reasons, the Fed is easing cautiously, corporate profits remain robust, and liquidity conditions are set to improve further as QT winds down. With the economy holding together and financial conditions easy, we continue to give the bull market the benefit of the doubt.

I hope your sweet tooth survived Halloween and you enjoy the first weekend of November!

Tim