Study Shows WHAT Clients Want Most From Financial Advisors

In Search Of Tranquillitas Ordinas

Sorry for the late delivery this fine, frosty Sunday morning. It seems the single-digit windchills in the Southeast have slowed down the internet…or me. But I hope this edition is worth the wait.

A new Vanguard study shows seemingly clear evidence of what investors most want to gain from their work with a financial advisor: peace of mind.

But even a thoughtful piece in The Journal of Financial Planning, attempting to define what that is and how the advisor/client combo can achieve it, left me unsatisfied. I think we need to go beyond the realm of the tangible to find insight into how best to achieve something that will never show up on a balance sheet or portfolio statement.

Our journey in search of peace of mind begins in North Africa in the 5th Century AD in this week’s Financial LIFE Planning submission, followed by Tony’s Weekly Market Update, exploring the future trajectory of policy rates.

If you’re on the Eastern seaboard of the U.S., it’s likely you’re experiencing a second weekend of historically low temps and winter weather, so I hope you stay warm and read on!

Thanks,

Tim

Tim Maurer, CFP®, RLP®

Chief Advisory Officer

In this Net Worthwhile® Weekly you'll find:

Financial LIFE Planning:

Study Shows What Clients Want Most From Advisors

Quote O' The Week:

Simone Weil

Weekly Market Update:

The Future Trajectory Of Policy Rates

Financial LIFE Planning

Study Shows What Clients Want Most From Advisors

Somewhere between 413 and 426 AD, Augustine, the Bishop of Hippo, addressed the cataclysmic event that shocked the whole world: the sack of Rome by the Visigothic leader, Alaric.

Tranquillitas Ordinas

But what may have begun as a defense of Christianity (for there was a movement to blame the fall of Rome on the abandonment of the Roman gods) became a treatise on how to seek and find an abiding peace. Peace of the body, peace of the soul, peace with fellow man, peace with God, domestic peace, civil peace, and the peace from which all of these spring—peace in all things, tranquillitas ordinas, or the tranquility of order.

And is it not true, some 1,600 years later, that a well-ordered life brings an uncommon calm amid what is often a chaotic world beyond us?

When we have a semblance of order in our homes, our relationships (both human and divine), our work, and yes, our money, tranquility seems to follow.

But we need to be more specific, don’t we, to better understand how we can find this overarching sense of order in our financial management that leads to this elusive peace of mind. Here are four pillars of peace, if you will, supported by philosophy and behavioral science, that both clients and advisors can deliberately pursue:

Pillar 1: Predictability

We need only go back 26 years in this case, to Baker and Stephenson’s work on “Prediction and Control as Determinants of Behavioural Uncertainty,” which suggests that it’s not certainty that is required to reduce our heart rate in adverse situations, but comprehensible uncertainty.

That’s good, because anything that involves financial markets involves inherent uncertainty; but what the research suggests is that we still feel calmer when we know what typically happens in certain situations, even if it’s a range of possibilities.

As advisors, we also know negative outcomes and their anticipation tend to have a more potent impact on our clients than positive possibilities and realities, so it suggests that we should dedicate a disproportionate effort to ensuring our clients understand the potential for downside than its more welcome inverse.

As advisors, we can follow Thich Nhat Hanh’s suggestion to “climb the mountain to look over the whole situation, not bound by one side or the other,” but to do so as a seasoned guide, pointing out the details and dangers of which our clients may not be aware.

But in order to be the most effective guides, our clients must believe in our competence, the second pillar.

Pillar 2: Fidelity

This one is tricky because it involves at least three components—competence, integrity, and benevolence—that require harmonization. Think of it this way: Peace of mind emerges when clients trust that their advisor’s competence is faithfully directed toward their best interests.

Yes, our clients need to know that we are competent, yet not for our sakes, but theirs. Therefore, a simple trumpeting of our superlatives will not do. We need to demonstrate our competence as much (and I’d argue more) through the space we create and the questions we ask than the resumes we’ve built.

And no matter how competent we are, if clients don’t know that we are truly trustworthy—integrous for them—it’s all for naught. A very recent study, “Behavioral Trust in Competence Versus Morality,” found that there is a general social norm against questioning someone’s moral integrity openly; but we do scrutinize competence.

It’s possible, I suppose, to be an incompetent fiduciary or a highly skilled selfish jackass, and our clients want neither. So, it becomes our job to demonstrate fidelity by showing competence deployed for our clients, not for ourselves.

But once we’ve established fidelity with a client, how can we directly support our clients’ peace of mind through our client experience?

Pillar 3: Visibility

Anxiety decreases when people can see the work being done and the logic behind it, and there are two ways we can navigate this effectively:

Proactive uncertainty reduction: anticipating what will happen and why

Retroactive uncertainty reduction: explaining what happened and connecting it to the framework

Behavioral finance professor and author, Dan Ariely, found that consumers are more confident when they understand the reasoning, not just the outcome. And this is where, I believe, the financial industry has done an exceptionally poor job.

The industry proper has created innumerable financial products and provided explanations ad nauseum for the features of those products. But how about connecting the dots for clients?

Even when this is done, the discussion often starts with the product rather than the purpose—the client’s purpose—and I believe if there is a single lesson to be learned from applied behavioral finance within wealth management, it is that we must perpetually connect the client’s personal purpose with the recommendations being made, regularly seasoned by gentle but persistent reminders.

The Vanguard study referenced above does suggest that “support” is the number one driver of peace of mind, but I think clients want (and need) more than just simple knowledge that someone is at the wheel. They need visibility in action, and one more key pillar for lasting peace of mind.

Pillar 4: Agency

Peace of mind increases when people have meaningful input into the process. Clients want participation without the burden of expertise. They want to see their own instincts and ingenuity considered and, whenever possible, confirmed and catalyzed.

The key insight from Ajzen’s Theory of Planned Behavior (1991, 2002) is that people feel better and behave more consistently when they perceive they could influence the process, even if they choose to delegate execution. And we can design client experiences to ensure that there are decision points where client input genuinely matters and shapes the plan.

Gable and Chin took it one step further to suggest that the consultant’s motivation to involve the client is as important as the client’s own desire for involvement. And here’s where we see clearly that these four pillars don’t operate in silos, but in concert.

The Four Pillars Working Together

These four pillars don’t operate in isolation. They create a reinforcing cycle:

When clients understand what to expect (Predictability) and trust that your competence serves them (Fidelity), they can relax into the process. When they see your work happening (Visibility) and have a genuine voice in decisions (Agency), they feel respected and in control. Predictability plus Visibility means they understand both the framework and its execution. Fidelity plus Agency means they trust your judgment enough to delegate, while maintaining the meaningful participation that humans naturally crave.

Together, these four pillars create what Augustine described nearly 1,600 years ago: tranquillitas ordinis—the tranquility that emerges when the affairs of one’s life are rightly ordered. Not controlled, but ordered. Not certain, but comprehensible and faithfully managed.

As financial advisors, we are not in the business of guaranteeing returns (of course!) or eliminating uncertainty. We are in the business of creating order. By honoring these four pillars—by making the future comprehensible, by directing our competence faithfully toward our clients’ interests, by showing our work, and by respecting our clients’ voice in their own futures—we create conditions from which peace of mind can emerge.

We are, in essence, helping order their financial lives in a way that reflects their deepest values and prepares them for what lies ahead. And when that order is established, the peace Augustine described—not the absence of challenge, but the presence of purpose and care—follows.

Quote O' The Week

Simone Weil (1909-1943) was a French philosopher, mystic, and social critic whose brief but intellectually fierce life produced writings of extraordinary depth. Working across philosophy, theology, and social commentary, she explored the fundamental conditions necessary for human flourishing—order, meaning, and spiritual sustenance. Her insights on the architecture of the soul remain as relevant to contemporary life as they were eight decades ago.

Weekly Market Update

Mixed markets this week, as larger companies (the world over) outshined their smaller counterparts:

+ 0.34% .SPX (500 U.S. large companies)

+ 0.63% IWD (U.S. large value companies)

- 1.95% IWM (U.S. small companies)

- 0.89% IWN (U.S. small value companies)

+ 2.05% EFV (International value companies)

- 0.33% SCZ (International small companies)

+ 0.18% VGIT (U.S. intermediate-term Treasury bonds

The Future Trajectory Of Policy Rates

Contributed by Tony Welch, CFA®, CFP®, CMT, Chief Investment Officer, SignatureFD

We learned late last week that President Trump is nominating Kevin Warsh for Fed Chair (more below). The process remains somewhat hairy owing to the recent DoJ subpoena of Jay Powell, but assuming he is confirmed, Warsh would be the 17th chair. And though a popular narrative is that Warsh is a hawk, Strategas Research points out that his views are more nuanced than that. He believes that the U.S. economy is experiencing a productivity boom in which rates can be lower without stoking inflation.

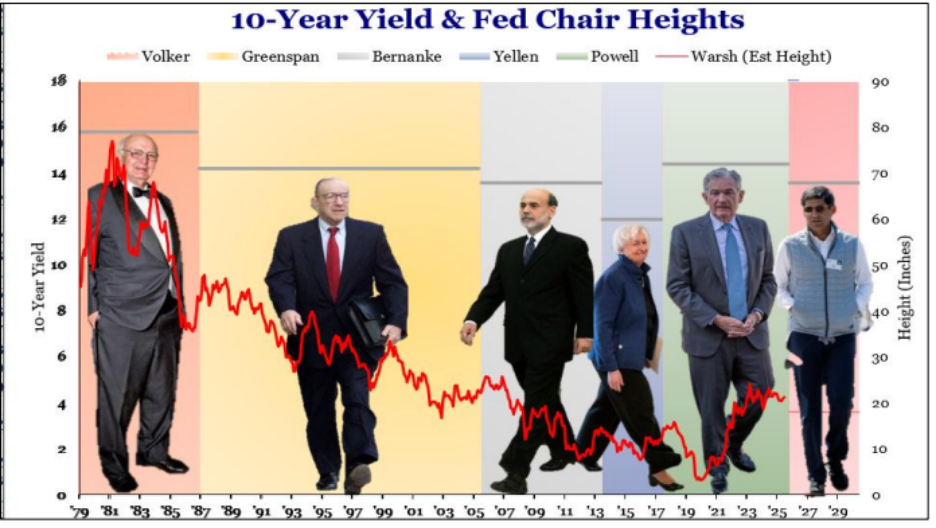

One interesting chart is the apparent correlation between changes in Fed chair height and interest rates. As Fed chairs continuously came in shorter than Volcker, rates were falling. Jay Powell bucked that trend of progressively shorter chairs and wouldn’t you know it, rates moved sustainably higher for the first time since Volcker’s tenure! Warsh is shorter than Powell, so just maybe we’ll get a new period of lower rates in the years ahead.

Chart O’ The Week

Source: Strategas Research Partners

The Message from Our Indicators

Recent data continue to describe an economy that is cooling from a strong pace rather than breaking down, with several crosscurrents worth keeping in context. One of the most visible has been the weakening U.S. dollar. While currency moves often attract dramatic interpretations, history suggests that periods of dollar softness more often align with global economic expansions than with stress. As growth broadens outside the U.S., capital flows tend to normalize and the dollar loses some of its safe-haven premium. That appears consistent with today’s environment, where global recession indicators remain subdued and non-U.S. equity markets are seeing improved participation. Importantly, a weaker dollar by itself does not guarantee stronger U.S. growth; trade benefits tend to be modest and secondary to domestic demand and productivity trends.

That said, the dollar is not irrelevant. A sustained decline can feed back into inflation through higher import prices and commodities, which helps explain the Federal Reserve’s continued caution. Recent Fed messaging has reinforced that while inflation risks have diminished, they have not disappeared. In that sense, currency stability may increasingly act as a constraint on how quickly or how far policymakers are willing to ease, particularly if inflation pressures re-emerge at the margins.

Those pressures are part of the backdrop facing consumers, whose confidence has softened in recent months. Sentiment surveys reflect ongoing affordability challenges tied to prices, interest rates, and housing costs. Yet the broader pattern that has defined this cycle remains intact: how consumers feel and how they behave continue to diverge. Despite lower confidence readings, labor market conditions remain firm and spending has held up better than sentiment alone would suggest. This disconnect has persisted for several years and remains a key reason the economy has continued to grow despite widespread caution.

Corporate earnings add another layer to this picture. As fourth-quarter results come in, the pace of upside surprises has slowed from near-record levels, which is more indicative of normalization than deterioration. After a period when estimates were unusually easy to beat, expectations are becoming more demanding. Encouragingly, earnings strength is no longer confined to the largest technology companies. Mid-cap and small-cap firms are showing improving beat rates, while profit margins remain elevated even as top-line growth moderates. This broadening beneath the surface is an important ingredient if earnings growth is to prove durable rather than narrowly concentrated.

Inflation data reinforce the need for balance. The latest Producer Price Index was firmer than expected on a month-over-month basis, a reminder that inflation pressures still exist within the supply chain even as consumer inflation has eased. Producer prices tend to lead consumer prices with a lag, which helps explain why policymakers remain cautious. The takeaway is not that inflation is re-accelerating, but that progress back toward price stability is unlikely to be linear.

Trade data and the deficit provide useful context, but little cause for alarm. While the trade deficit widened in the most recent month, the longer-term trend still shows gradual narrowing on a twelve-month basis. From a growth perspective, trade remains a modest contributor rather than a dominant driver. From an investment standpoint, shifts in the dollar and global capital flows are far more consequential than the absolute level of the deficit itself.

Taken together, the indicators point to an economy that is slowing in an orderly way, not slipping into recession. Dollar weakness reflects global dynamics more than domestic fragility. Consumers are cautious but employed. Earnings growth is broadening, even as expectations rise. Inflation is easing, though not fully extinguished. In this environment, disciplined diversification is more important than making aggressive macro bets in either direction.

Let’s think of discipline and order this week not as restrictive burdens, but as tools on the path to freedom.

Tim