The Charitable Assumption: A Better Default for Managing Money and Relationships

Lessons From The World's #1 Restaurant

Stephen Covey, the author of The 7 Habits of Highly Effective People, tells a story that’s as instructive as it is unsettling. On a New York subway, he noticed a man sitting quietly while his children wreaked havoc. Covey finally said, “Sir, your children are really disturbing a lot of people.”

The man replied, “You’re right. We just came from the hospital where their mother died about an hour ago.”

I share that feeling that likely just churned in your gut—because, if you’re anything like me, you may have rarely corrected a parent for their apparent mismanagement of an unruly child, but you sure have turned around conspicuously, glared, or even mustered up a hopefully anonymous “Shhhh!”

Now please forgive yourself, because this is a well-documented tendency dubbed the fundamental attribution error, where we default to excusing our own mistakes by attributing them to external factors—while judging others’ mistakes as reflections of their lacking character. Eeesh.

The point, of course, is that we rarely don’t know the story behind the story—and this blind spot makes us vulnerable to the mismanagement of our relationships, and especially our relationships where money is involved.

Fortunately, we’re offered an antidote to this poisonous bias, and I’ll offer three practices that we can apply to retrain our hearts and minds that I hope will reduce your stress in life and lead to more effective money management.

And Tony’s back this week with a clarifying market commentary, asking whether U.S. national debt is unsustainable, so thanks for joining us—and please read on!

Tim

Tim Maurer, CFP®, RLP®

Chief Advisory Officer

In this Net Worthwhile® Weekly you'll find:

Financial LIFE Planning:

The Charitable Assumption: A Better Default

Bonus Podcast:

How To Change Your Money Scripts

Quote O' The Week:

Plato (via Wendy Mass)

Weekly Market Update:

Is U.S. Debt Unsustainable?

Financial LIFE Planning

While this particular antidote has been discussed by philosophers and theologians for millennia, I learned this new phrase from the best-selling book, Unreasonable Hospitality, written by the world’s top restauranteur, Will Guidara.

Guidara was half of the guiding force, along with Chef Daniel Humm, that led Eleven Madison Park to become known as the best restaurant in the world by The World’s 50 Best Restaurants. Part of their success, however, was Guidara’s insistence that they not replicate the hostile work environment for which the restaurant business has become notorious. (See The Bear.)

They developed a code that cultivated a cultish culture among the employees, helping EMP reach such lofty heights, and one of the core components is the charitable assumption, which Guidara defines simply as “a reminder to assume the best of people, even when (or perhaps especially when) they weren’t behaving particularly well.”

As you might imagine, they only hire the best-of-the-best culinary and service staff at the world’s best restaurant, so if one of those exceptional servers was late, unusually inhospitable, or underperforming, the charitable assumption insisted that there must be something circumstantial—not character-driven—that led to the anomalous behavior.

Therefore, the question to said employee would be, “Hey, is everything ok?” not “What’s wrong with you??” or worse yet, the gossipy, “Can you believe they just did that?” which tends to fester like a disease, whether in an organization or a household.

3 Charitable Assumption Practices

Speaking of household, let’s turn our attention to three practices that can help us apply the charitable assumption in our lives, loves, homes, and finances:

1. Be Charitable To Yourself

I think it’s important to start with ourselves, because often times our tendency to blame others is actually rooted in self-flagellation. Eckhart Tolle says, “Anything that you resent and strongly react to in another is also in you.” And as much as I want to argue with this quote, I think he’s on to something.

It’s exceedingly difficult to show grace to others when we can’t—or won’t—show it to ourselves. Fortunately, the management of our personal finances is ripe territory for learning this lesson—because it’s not likely that a year, month, or even a week will expire without you making a financial mistake.

In fact, money management is more an exercise in mistake management than an unachievable perfection—partly because the complexity of money today makes it virtually impossible to catch everything in real-time, and partly because there is much that is beyond our control…and even more that is beyond our consciousness.

Carl Jung said, “Until you make the unconscious conscious, it will direct your life and you will call it fate.” We’ve learned that much of what we do with money in adulthood is based on formative hard-wiring we endured before the age of 10.

The financial advisor / psychotherapist trio of Rick Kahler, Ted Klontz, and Brad Klontz gave this phenomenon a helpful moniker—money scripts. These are often more feelings than thoughts that guide our behavior when we react to whatever stimuli we face.

That wince you feel when your friend asks if you want to split the bill even though they racked up the apps and drinks while you were careful? The way you respond to a homeless person asking for money? The pride you feel when sporting a Louis Vuitton purse? These instantaneous responses are all money scripts. And it is through their exploration that we can identify, articulate, and, if desired, change them.

Exploring our money scripts helps us extend a charitable assumption inward—to understand our own choices with compassion rather than criticism.

2. Be charitable to your spouse.

If you want to live dangerously, talk to your spouse or partner about money. If you want to seriously risk your marriage, don’t.

Money mismanagement mangles marriages. And you already know why—because we often don’t even know our own money scripts, much less our spouse’s—so this becomes ground zero for the financial misapplication of the fundamental attribution error.

If you want a crash course, check out the funnily named book, The Financial Wisdom of Ebeneezer Scrooge, a short collaboration of the trio mentioned previously, and please don’t wait until the holidays to do it.

But you don’t have to learn anything else to be a student of your spouse. You used to grant them the charitable assumption—remember? Once infatuation set in, early in your dating, no matter what story they told about their past, present, or aspirations for the future, they seemed somehow infallible.

You can do it again. Set 60-90 minutes aside—without those rambunctious kids around and with your favorite deliberative beverage—and tell your personal money stories to one another. Without judgement, listen and share, the most indelible memories you have of money growing up. Before the end of this exchange, you should begin to see your partner not as the miser or spendthrift you’ve come to label them, but as the collection of a lifetime of experiences and circumstances that have shaped them.

If you want a template, my wife, Mika, and I recently had one of these conversations—unscripted and on camera—not because we are marriage experts, but simply because we were willing. I hope you find it helpful.

And if you want an even simpler start, simply ask your spouse, “What’s one of your earliest memories about money?” And then listen curiously, not critically.

3. Be charitable to your friends…and your “friends.”

OK, I’ve saved the hardest for last—because I know that even though you hit the like button, or even commented with a cute emoji, when your neighborhood acquaintance sent a slew of pictures from their recent trip to Ibiza, you were actually thinking, “They can’t really afford that!”

And maybe they can’t. Maybe they can’t afford their house(s) or car(s) either—but maybe they can. Or maybe they’re the person who just went through a tragic season in life and spent their life savings to splurge on a soul-filling adventure to remind themselves that there is beauty in the world.

The soul-sucking danger of comparison is alive and well in 2025, and it really doesn’t hurt whomever we’re judging at all—it only hurts us.

So, here’s an idea: Let’s try curiosity over condemnation.

The Best Part About Charity

The best part about charity is that it doesn’t actually require financial wealth. We tend to equate charity, generosity, and philanthropy as the sole domain of the ultra-wealthy. But my favorite author of all time—C. S. Lewis—offers us a simpler, more potent view of the virtue of charity:

“Charity means love,” Lewis says, but love “does not mean an emotion. It is a state not of the feelings but of the will; that state of the will which we have naturally about ourselves, and must learn to have about other people.”

Of course, many of us never learn what Lewis insists we must. And I submit that no matter how rich, our lives are poorer for it. In those moments when we wallow in self-pity, blame those closest to us, or judge those with whom we interact, we turn what could be a lesson learned, a relationship deepened, or a curiosity satisfied into little more than the false god of self-righteousness—or worse yet, a general mistrust of everything and everyone (which social media and the news are happy to profitably stoke).

On the other hand, the generous assumption isn’t just a mindset, it’s a multiplier of trust. It softens our inner critic, strengthens our closest relationships, and builds bridges where money so often builds walls.

This post was originally published for Forbes.com.

Bonus Podcast

Quote O' The Week

Plato (via young-adult author, Wendy Mass)

“Be kind, for everyone you meet is fighting a hard battle.”

Weekly Market Update

Markets had another nice week, across the board:

+ 1.88% .SPX (500 U.S. large companies)

+ 1.26% IWD (U.S. large value companies)

+ 1.24% IWM (U.S. small companies)

+ 1.29% IWN (U.S. small value companies)

+ 0.44% EFV (International value companies)

+ 1.25% SCZ (International small companies)

+ 0.61% VGIT (U.S. intermediate-term Treasury bonds

Is U.S. Debt Unsustainable?

Contributed by Tony Welch, CFA®, CFP®, CMT, Chief Investment Officer, SignatureFD

Two weeks ago, Moody’s was the final of three credit ratings agencies to downgrade U.S. debt from its Aaa rating. The downgrade renewed media attention on the U.S. fiscal situation and its sustainability. Moody’s pointed to the growing national debt, ongoing budget deficits, and relatively high interest payments as reasons for the downgrade. Longer-term treasury rates rose in the immediate aftermath of the downgrade, and understandably, we have been receiving client questions.

It is difficult to determine in real-time what constitutes a sustainable debt level. Japan has been running a deficit of about 200% of GDP since the Global Financial Crisis without much impact on long-term bond yields. But our partners at Ned Davis Research point to three metrics we can watch in real-time to gauge sustainability in the U.S.

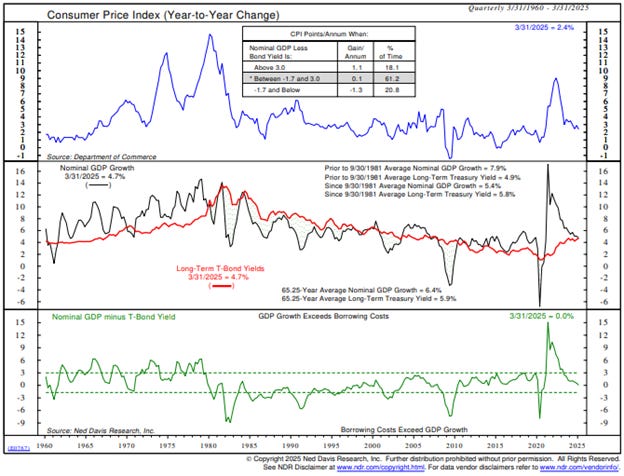

The first is the term premium. The term premium refers to the amount investors demand in excess yield to take on the risk of longer-term Treasuries. That has been climbing, indicating that investors may be becoming increasingly uncomfortable with the U.S. fiscal situation. The next is the credit default swap (CDS) rate on U.S. debt. CDS is somewhat elevated today, but it does not yet appear to be a disaster. Finally, the chart below compares nominal economic growth to long-term Treasury yields. When growth exceeds financing costs, a growing debt load can make sense. But when economic growth is less than the funding cost, then new debt is likely unproductive. Today, the two have converged, and while not yet problematic, it remains something to watch.

The Moody’s downgrade itself is not a surprise given that the other two agencies had already downgraded U.S. debt, and Moody’s had the U.S. on a negative watch. Rather, the downgrade was a confirmation of what investors already knew – the fiscal situation might be ok for now but could become unsustainable if changes are not made, particularly if rates are higher than economic growth.

The Message from Our Indicators

Last week included some impactful data on housing, consumer and CEO confidence, personal income, outlays, and inflation. Existing home prices fell 0.3% in March, marking the first monthly decline in prices in about two years. Pending home sales slipped -6.3% in April. There continues to be an affordability issue owing to little supply and high mortgage rates. Consumer confidence rebounded as the markets recovered and some tariffs were rolled back. But CEO confidence dropped by a record amount owing to the mixed messages regarding trade policy. Probably the most impactful report came in on Friday, the Personal Income and Outlays report. That report not only includes income and spending but also the Fed’s favored PCE inflation metric.

Personal income increased by 0.8%, which was significantly higher than expected. However, the rise was driven primarily by an increase in social security payments. Consumer spending rose 0.2%, essentially in line with the increase in income. Transfer payments. Inflation remained benign, as the PCE price index rose only 0.1% in April and 2.1% over the past 12 months. Thus far, economic data has held up despite policy uncertainty. In our view, the economy is likely growing below trend, but not yet near recessionary levels.

According to the CME Group, the current market expectation for a Fed rate cut in June is only about 2%. This batch of economic data is supportive of easier Fed policy; however, the market is betting that the Fed will wait for more evidence that tariffs are not impacting inflation before resuming the rate-cutting cycle. Lower rates would likely benefit both stocks and bonds. For now, interest rates have risen enough for us to rate the monetary backdrop as neutral rather than bullish. Rising corporate bond yields have historically put pressure on the average stock in the U.S. and global markets. Following a strong rally from the April low, it would not be unusual to see a period of choppy trading and volatility in the weeks ahead.

That said, the technical indicators have improved significantly and bode well for forward 12-month returns. We often discuss “market breadth” in this section of the newsletter. By market breadth, we simply mean the percent of stocks that are joining in the uptrend. Historically, when most stocks are participating, we can have more confidence in the bull market from a forward-looking perspective. All told, the weight of the evidence leans bullish for stocks relative to bonds. However, the range of outcomes is likely quite significant. Proper diversification remains a sensible strategy in 2025.

Maycember is over—whew!—hope you enjoy the new month.

Tim