The (False) Dichotomy Of Investing Before And After Retirement

Before retirement, investing is offense. After retirement, it’s defense. Or so the playbook says.

This beginner’s logic is better guidance than none, I suppose. It is true, after all, that when investing before retirement, time is on your side—and with more time, you can take more risk. And it’s also true that retirees face a more challenging math problem, once they are facing both market volatility and prospective distributions to fund life without a salary.

But as personal finance rules of thumb often do, this one falls short—and may even be dangerous—because each personal situation is genuinely unique. This can require addressing the problem, or problems really, from a different perspective.

In this week’s Net Worthwhile® Weekly, we’ll offer that perspective, first in our feature article this week and then in the NWWW podcast where Tony Welch and I dissect the topic further. And Tony finishes this week’s edition off with a Weekly Market Update—he’s keeping an eye on the markets, so you don’t have to.

Thanks for joining us and enjoy your extra Sunday this weekend!

Tim

Tim Maurer, CFP®, RLP®

Chief Advisory Officer

In this Net Worthwhile® Weekly you'll find:

Financial LIFE Planning:

The (False) Dichotomy Of Investing Before And After Retirement

Net Worthwhile® Podcast:

Offense, Defense, or Both?

Quote O' The Week:

Cynthia Bourgeault

Weekly Market Update:

Lower Rates Could Benefit Main Street

Financial LIFE Planning

The (False) Dichotomy Of Investing Before And After Retirement

Investing Before Retirement

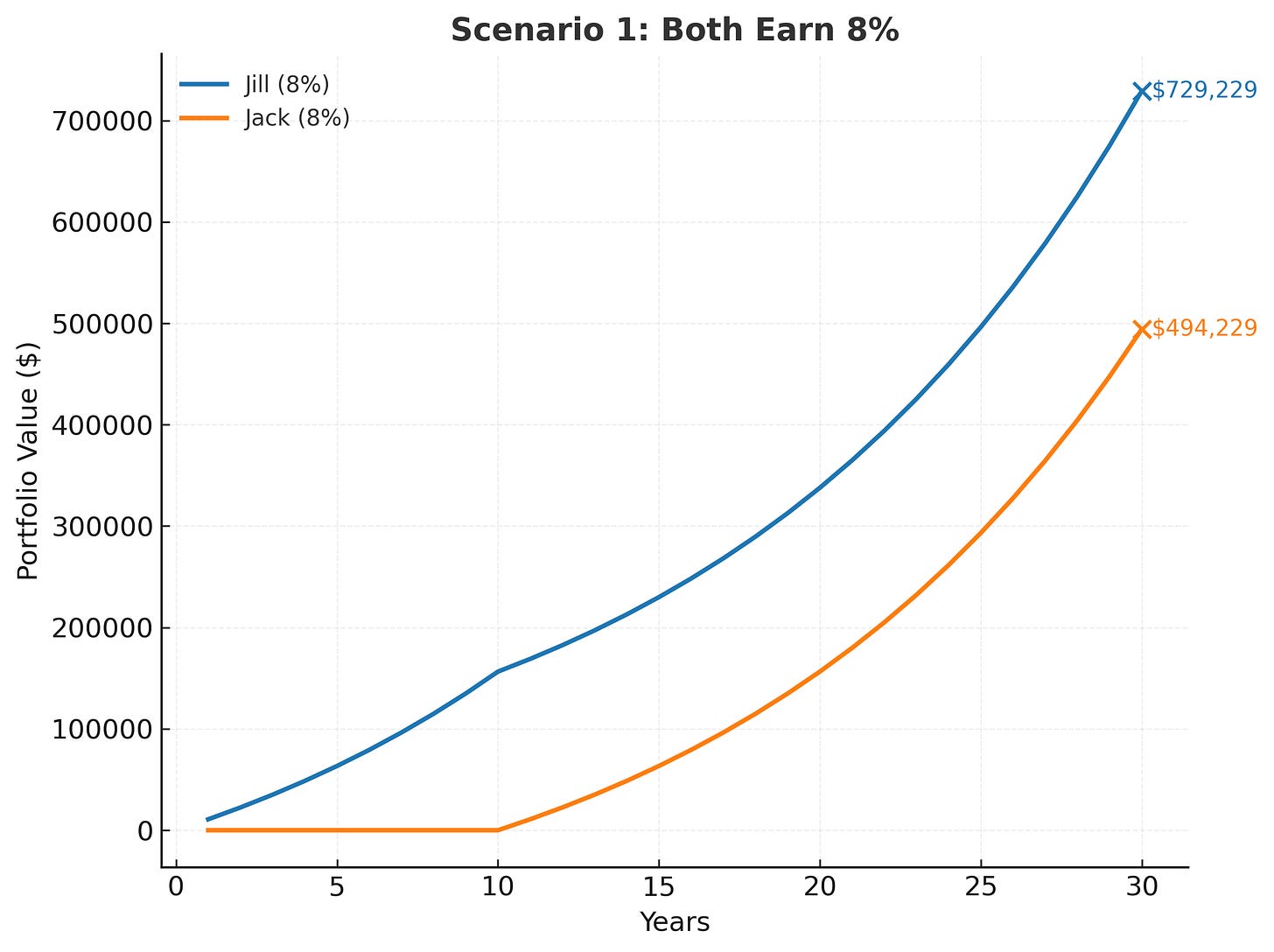

Yes, time is on your side, and compounding really works. You’ve probably heard the investing tale about the twins, Jack and Jill, where Jill starts saving $10,000 per year at the age of 20 and stops after 10 years. Jack, living up to the stereotype of the young adult male, decides he wants to live it up a bit more in early adulthood and waits to start saving until he’s 30, but he invests for 20 years—twice the overall investment of Jill.

They each earn 8% (making their contributions at the beginning of each year), and at the end of the 30-year stretch, Jill has $729,229 to Jack’s $494,229, all because Jill had more time for the investments to grow.

But time isn’t the only factor to consider in determining how you should be invested. As I discussed recently, time—your ability to take risk—is only one of at least three factors. The other two are your need to take risk (how much risk you need to take in order to meet your goals) and, most importantly, your willingness to take risk (how much market volatility you can stomach).

Taking all three of those factors into account can dramatically impact the way one’s portfolio would be optimally invested, and that, in turn, can create a meaningful shift in outcomes.

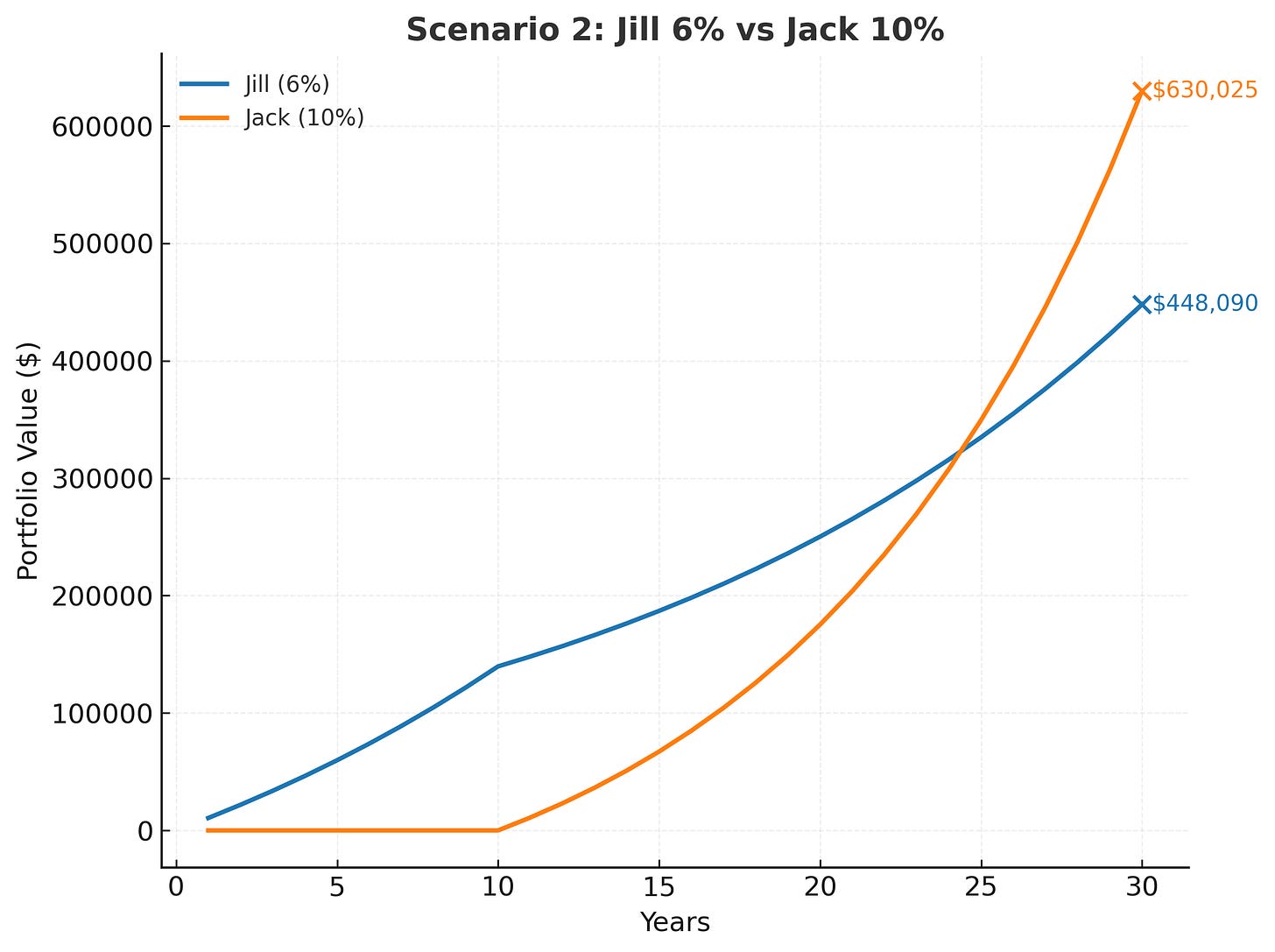

For example, let’s say Jill is a very conservative investor, and as a result, her portfolio only earns 6% per year; meanwhile, Jack is a more aggressive investor and ends up earning the rough historical average return of 10%. In that case, Jack would actually make it up the hill first, if you will: Jack has $630,025 and Jill has $448,090.

Interesting, isn’t it? But accumulation math and distribution math are not the same game.

Investing After Retirement

But what happens when we apply this logic to retirees who are taking distributions to supplement income in retirement? The math gets even more complex, and the greatest threat to your portfolio might be sequence of returns risk. As defined by David Blanchett and Larry Frank in their Journal of Financial Planning paper, “Sequence of returns risk is the danger that the timing of withdrawals from a volatile portfolio will interact with the order of investment returns to increase the likelihood of portfolio depletion.”

Translated, that means if you head into retirement with a higher volatility portfolio and the market delivers a series of negative returns out of the gate, the fact that you are also taking distributions from the portfolio in those years compounds the early losses and can cripple your retirement income plan surprisingly quickly.

The next scholarly article you might read may suggest that longevity is the greatest risk in retirement, necessitating that you take more risk. While another implores you should use a “rising glidepath” approach, beginning with lower risk at the beginning of retirement, and actually increasing the amount of equity exposure over time.

What’s the problem?

I see three major problems with all these different illustrations of investing, both before and after retirement:

Markets don’t read these studies. Every one of these examples uses estimates of what markets will do based on averages and past market performance which, indeed, may never replicate. The markets are going to do whatever they want, regardless of what a study says.

Your life is not a hypothetical case study. You’re not Jack or Jill—at least the ones referenced here—and you’re also not one of the examples used in any of these studies. Your life and financial situation is unique and I believe must be treated as such.

The examples used are typically binary at best. Often times, these studies are only looking at one bucket containing two asset classes—stocks and bonds, or mutual funds comprised of them. Real life may well require more buckets, more asset classes, more nuance, and more adaptability.

A 4-Bucket Approach to Investing, Before AND After Retirement

I prefer a four-bucket approach to investing that is surprisingly adept at navigating changes to markets and lives, both in the accumulation stage as well as once distributions start.

Instead of viewing retirement as a cliff, “GPGL” reframes investing as a continuum:

Grow: Before retirement, it’s compounding wealth. After, it’s maintaining purchasing power and staying ahead of inflation.

Protect: Before, it’s diversification and insuring against catastrophic risks. After, it’s stabilizing income streams and healthcare protection.

Give: Before, giving is often aspirational and deferred. After, it becomes more immediate—supporting, and investing for, causes or family directly.

Live: Before, it’s about not deferring all joy. After, it’s about sustaining lifestyle with purpose.

This is an inherently dynamic approach to portfolio management that is more of an ever-evolving continuum. GPGL doesn’t flip a switch at retirement—it just marks a shift in emphasis that allows for fluidity and the only variable in life and investing that is guaranteed: change.

There’s no magic to the order in which you populate your respective buckets with the investment and income elements that are optimally suited for you. In fact, I like to start by filling your Protect and Live buckets first, because these are the two that tend to offer sleep-at-night peace for investors. Filling these buckets tends to have the effect of building the confidence necessary to be a capable grow investor and casting the vision to develop your approach to giving, whether it’s of the compulsory variety (taxes) or to the people and causes most important to you.

The truth is that investing isn’t a game that switches from offense to defense when you retire—it’s always both. GPGL reframes the game, reminding us that money is not a static stockpile but a set of resources to grow, protect, give, and live.

Markets and life will change, and rules of thumb will rise and fall. But an approach anchored in GPGL adapts across the continuum from your working years into retirement, helping you invest with clarity no matter where you are on the field.

Net Worthwhile® Podcast

Quote O' The Week

Cynthia Bourgeault is an Episcopal priest, modern mystic, and bestselling author known for her work on contemplative practice and nondual consciousness.

Weekly Market Update

Markets were mixed this week, and no, that’s not a misprint; two pairings of the indexes we follow had identical returns:

+ 0.33% .SPX (500 U.S. large companies)

- 0.02% IWD (U.S. large value companies)

+ 1.11% IWM (U.S. small companies)

+ 1.11% IWN (U.S. small value companies)

+ 0.24% EFV (International value companies)

+ 0.24% SCZ (International small companies)

+ 0.27% VGIT (U.S. intermediate-term Treasury bonds

Lower Rates Could Benefit Main Street

Contributed by Tony Welch, CFA®, CFP®, CMT, Chief Investment Officer, SignatureFD

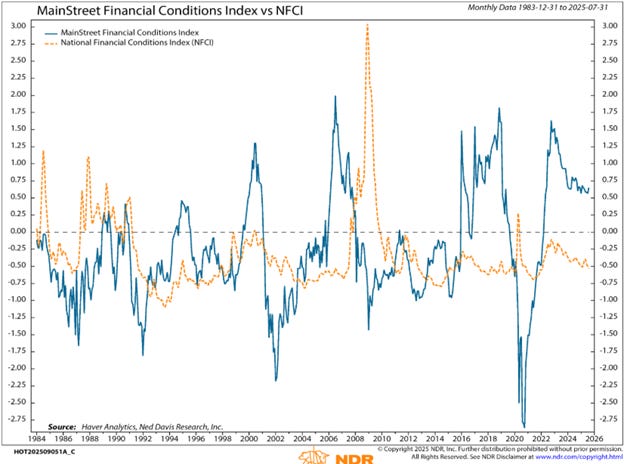

While markets have enjoyed relatively easy financial conditions, households are still feeling the pinch. The chart below compares:

Main Street Financial Conditions Index (NDR), measuring real home prices, mortgage rates, and consumer credit standards. A higher reading signals that borrowing and credit conditions for households are tighter.

National Financial Conditions Index (NFCI, Chicago Fed), tracking market-based indicators such as credit spreads, equity performance, and funding costs. A lower reading signals easier conditions in financial markets.

Today, the gap between the two is unusually wide. Market-based conditions look loose, but Main Street remains historically constrained by high mortgage rates, tight credit standards, and pressure in the housing market.

This divergence highlights why the Fed is under pressure to cut rates. Monetary easing might not be needed to support Wall Street, but it could make a meaningful difference for Main Street households struggling with borrowing costs and affordability.

Chart O’ The Week

The Message from Our Indicators

The latest employment data confirms that the labor market cooling we saw from May through July has carried over to August as well. Payroll growth has slowed to its weakest pace since the pandemic (+22,000 jobs in August), job openings have slipped below one per unemployed worker for the first time since 2021, and layoff announcements are picking up. While unemployment remains low by historical standards, the trend is moving in the wrong direction and signals some strain on Main Street households. Additionally, the job creation is relatively concentrated in leisure and hospitality, private education, and health care. More cyclical sectors like manufacturing and construction saw job losses in August.

At the same time, inflation expectations remain well anchored and productivity has improved, easing wage-price pressures. This combination of softer growth and contained inflation has raised the likelihood that the Federal Reserve will cut rates in September. Still, we believe the job market is likely not weak enough to support a 50 basis point, emergency rate cut. That said, a shift toward easier policy could help lower borrowing costs and support consumer credit conditions, offering some relief to households and businesses.

On a positive note, corporate earnings have held up better than expected, with technology companies delivering double-digit revenue gains and other sectors maintaining margins through cost control. Equity markets have remained resilient on the back of this earnings strength and in anticipation of Fed easing, though we remain mindful of seasonal volatility and policy risks.

Longer-term risks tied to tariffs, tighter immigration policies, and rising electricity costs could weigh on growth while keeping certain prices elevated. Taken together, the market is digesting a balance between a weakening labor market but easier monetary policy. That balance will be key as we look toward the close of 2025. But for now, we would give the bull market the benefit of the doubt owing to solid corporate fundamentals and upcoming Fed easing.

Indeed, let’s hope the bulls—and the Ravens—win! :-)

Tim