The Transactional Trap: Career Life Advice From Rock Star Billy Corgan

“I had a million dollars by the time I was 24 years old. A year before that, I was making $12,000 a year working at a record store, and I was broke.”

So starts a two-minute video that a friend implored me to watch—twice—this week, and by the end of the second time, the truth hit me so hard that my eyes welled up. I knew I had to share it with you, if only to ensure that it sunk more deeply into my consciousness, but I believe there’s something here for you, too.

I’ll share some surprising advice to be applied in work, life, and money this week from a legendary rock star before Tony updates us on a big week for the markets that *may* give us some insight into where interest rates are headed.

Tim

Tim Maurer, CFP®, RLP®

Chief Advisory Officer

In this Net Worthwhile® Weekly you'll find:

Financial LIFE Planning:

CareerLife Advice From Rock Star Billy Corgan

Quote O' The Week:

Denzel Washington

Weekly Market Update:

Tax Cuts Outpacing Tariffs

Financial LIFE Planning

Life Advice From Rock Star Billy Corgan

This wisdom came from the lead singer of the band Smashing Pumpkins, and if you weren’t in high school in the early ’90s, the weight of his words may require some perspective.

First, it was the ‘90s, friends, the decade for which the only competitors for the “Bestest Decade In The History Of Music” are the 1960s and the 1790s, when Mozart “released” Requiem and Beethoven’s first piano sonatas were performed.

The Pumpkins sold 30 million albums in the ‘90s alone. They were Spin magazine’s Artist of the year in 1994. At MTV’s VMAs in 1996, they had the most nominations (9) and most wins (7) of any band. And they were the only band to have two albums listed in the “Readers Pick the Top 10 Albums of the Nineties” in Rolling Stone magazine.

They were kind of a big deal. Furthermore, when Corgan was 24, in 1991, a million dollars would feel more like $2,371,865 today, in 2025. And to illuminate their staying power, he’s still playing in front of tens of thousands of people today.

So Corgan had checked every box—and about 50 more—that millions of struggling artists yearn to check when he was still in his twenties. I’d argue that he’d have every reason to fall into that cadre of mercurial artists who apparently lose touch with reality and fall prey to personal deification scripts.

But instead, drawing on Ecclesiastical wisdom, Corgan expands on the perspective he’s gained, describing almost all of his professional success with a particularly interesting word: transactional.

“[T]he problem with all of it is that it’s transactional,” he explains, “because no matter how many hit songs you write, it’s always, what about the next one? No matter how many records you’ve sold, there’s always somebody who’s going to sell more. There was always, like, an asterisk or a qualifier.”

And isn’t that the transactional trap? You’re only as good as the next thing you do?

Allow me to make you a little uncomfortable for a second: No matter how good you are at your job—and no matter how beloved you are at that company—if you lose your edge, you’re also likely to eventually lose your job.

That’s just how it works. Our work is conditional. And even the highest of high performers up to this minute will only retain that status if they retain that performance. In fact, once you’ve reached that peak, it tends to be even more noticeable when you inevitably slip (because we all do).

But while dealing with those slips is fodder for another post—and maintaining high performance is yet another—what I really want you to feel is the lesson Billy Corgan delivers on the only thing that does truly satisfy:

“Unconditional love.”

It’s coming home from one of your worst days, only to collapse into the arms of a partner, parent, or friend who loves you for reasons other than your job title.

It’s coming home from one of your best days to find a teenager who isn’t the slightest bit impressed with anything you’ve ever done, but who (silently) couldn’t imagine life without you.

It’s walking in the door on any day to hear a toddler’s footsteps racing in your direction, desperate to behold you, and they don’t even know what you do for a living.

It’s finding supernatural love through faith that provides a source of sustenance when the humans who love us unconditionally fall short, themselves.

It’s a reminder that while money and titles are important, I believe they’re not the full measure of wealth, which also includes who and what we’d never trade away.

It’s truly believing some version of what Billy Corgan says to his kids after they dance with him onstage in front of 40,000 people:

“No matter what you see daddy do, no matter what you hear about daddy…you are so much more important than that to me. I would trade all of this for you.”

Special thanks to Dr. Daniel Crosby for sharing the only redeeming thing I saw on X this week.

Quote O' The Week

Denzel Washington drops the mic with this one:

“Success? I pray that you will put your slippers way under the bed at night so that you have to get down on your knees in the morning to reach them. And while you’re down there, thank God for family, for love, for people who really matter.”

Weekly Market Update

Domestic markets were up this week, with the S&P 500 setting another all-time high, while international stocks were slightly negative:

+ 1.22% .SPX (500 U.S. large companies)

+ 0.07% IWD (U.S. large value companies)

+ 1.95% IWM (U.S. small companies)

+ 0.77% IWN (U.S. small value companies)

- 0.81% EFV (International value companies)

- 0.20% SCZ (International small companies)

- 0.18% VGIT (U.S. intermediate-term Treasury bonds

Tax Cuts Outpacing Tariffs

Contributed by Tony Welch, CFA®, CFP®, CMT, Chief Investment Officer, SignatureFD

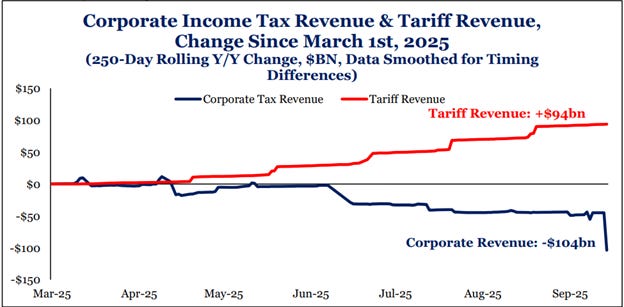

The market had to deal with a healthy dose of spinach before it got any candy this year. The Liberation Day tariff announcements created a major headwind back in April. But on July 4th, the One Big Beautiful Bill Act was signed into law, with the potential to sterilize the tariff collections. The chart below shows that the change in corporate income tax collection has fallen by $104 billion in the last 12 months, while tariff collections have grown by $94 billion.

It's an important offset as we think about the health of the labor market. Hiring has slowed to a trickle, but we’re not seeing a pick-up in layoffs, implying that companies are largely holding onto their workers. We wouldn’t expect wide-ranging layoffs if corporate profits are expanding, which is currently the case. And while tariffs threatened to dent earnings, the offset from lower taxes is providing a direct counter. For now, the bull market is supported by improving fundamentals.

Chart O’ The Week

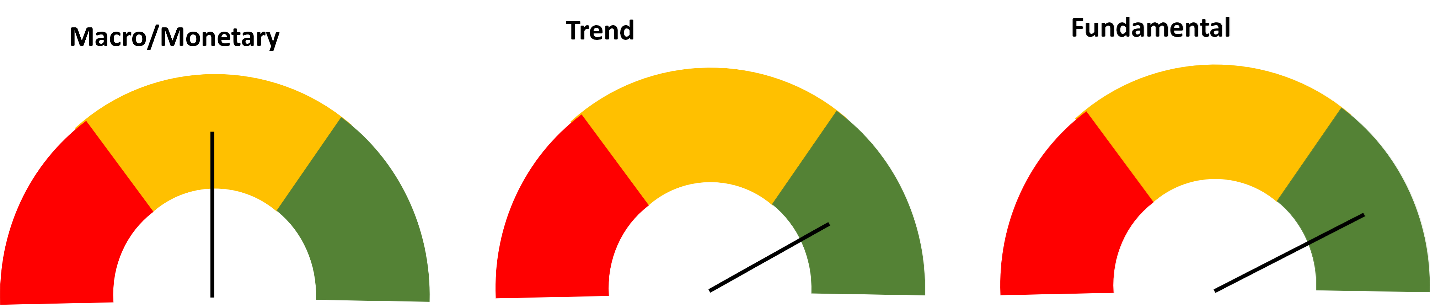

The Message from Our Indicators

The market had to deal with a healthy dose of spinach before it got any candy this year. The Liberation Day tariff announcements created a major headwind back in April. But on July 4th, the One Big Beautiful Bill Act was signed into law, with the potential to sterilize the tariff collections. The chart below shows that the change in corporate income tax collection has fallen by $104 billion in the last 12 months, while tariff collections have grown by $94 billion.

It's an important offset as we think about the health of the labor market. Hiring has slowed to a trickle, but we’re not seeing a pick-up in layoffs, implying that companies are largely holding onto their workers. We wouldn’t expect wide-ranging layoffs if corporate profits are expanding, which is currently the case. And while tariffs threatened to dent earnings, the offset from lower taxes is providing a direct counter. For now, the bull market is supported by improving fundamentals.

I hope you have a fundamentally awesome rest of your weekend!

Tim

I love Billy and the Pumpkins and have been a fan pretty much since their beginning...

But, as an 80s high schooler, I'll defend to my dying breath that they were the best music decade ever 😉

Great article, Tim!

How utterly, beautifully true. Thanks.