There Actually Is A Free Lunch

This Myth Needs To Be Debunked

You’ve heard the saying, “There’s no free lunch,” right? It’s designed to caution against believing you can receive anything of value for free—that if someone is offering you something valuable at no cost, it must ultimately be for their own selfish benefit.

And while this warning may well apply to situations where a transactional salesperson offers something of lesser value to entice you into purchasing something far more expensive, that’s not the whole story. In fact, I believe this underlying notion—which effectively presumes “everyone is out to get you”—creates a host of missed opportunities, both to give and receive invaluable insights that could change the course of your academic path, your career, and your life.

I’ll discuss that in this week’s Financial LIFE Planning section, including offering 3 ways to get free lunches and 3 ways to give free lunches. Tony’s Weekly Market Update follows with some insight into why more stocks are beating the index.

Thanks for joining for this week’s Net Worthwhile weekly!

Tim

Tim Maurer, CFP®, RLP®

Chief Advisory Officer

In this Net Worthwhile® Weekly you'll find:

Financial LIFE Planning:

There Actually IS A Free Lunch

NWWW Podcast (New!)

A Cold Call And A Life-Changing Invitation

Quote O' The Week:

Brené Brown

Weekly Market Update:

More Stocks Beating The Index

Financial LIFE Planning

There Actually Is A Free Lunch

It was poet and author David Whyte who confronted me with the relative absurdity of the free lunch maxim. He suggests that from the time of our birth, most of us receive loads of freebies without any expectation of reciprocity.

The Invisible Help All Around You

Our very navigation from conception to independent adulthood involves an enormous amount of freely given meals, clothing, shelter, and the best life lessons our parents could offer.

If, like me, you attended public school, the foundation of your knowledge was also gratis. And even if you prefer the cynical argument that taxes paid for it, consider those teachers, administrators, and coaches who went the extra mile—giving us far more than their job descriptions required. (Plus, your parents definitely paid less than neighbors who chose the private school path.)

Thanks to the illumination of folks like Ron Lieber, author of The Price You Pay For College, we’ve learned that even the priciest higher education can also cost far less than sticker price.

And despite how much any of us prefer to believe our career success is ours alone, take ten seconds to think of a solid handful of people (it’s probably scores if you take a few minutes) upon whose shoulders you’ve stood to reach those higher rungs on the occupational ladder.

Whyte asks the potent question: “Are you turning a blind eye to the invisible help that is all around you?”

I don’t think this is designed as an indictment, but an invitation. Let’s look at a few of those invitations now.

3 Ways To Get Free Lunches

1) Be Open To Free Help

The first thing we must do to benefit from the many free lunches out there is be open to free help. A few amazing people taught me this lesson before I’d even entered the professional world. One was Ernie Kiehne, a name that may only be known to students of investing in the ‘80s and ‘90s.

Ernie Kiehne was a Bell Labs employee and client of the (then) brokerage firm Legg Mason, based in my hometown of Baltimore. As legend goes, the firm noticed their client was outpacing the professional stock pickers, so they offered him a job. He joined Legg Mason in 1967 and co-founded the Legg Mason Value Trust with famed investor Bill Miller in 1982.

Yet Kiehne continued working at the firm well into what “should’ve” been his retirement. He came to speak in a large lecture hall for one of my investing classes at Towson University in 1998. He seemed so genuine that I called Legg Mason the next day and asked to speak with him—and he invited me to visit.

Still reeking of the previous night’s foolishness in the one suit I owned, I clumsily found my way to his office with the best view of Baltimore I can recall seeing, and he started asking questions—mostly about me and my family.

Shortly after, he made a phone call and I had a job—my first “real” job—at the most reputable financial firm in my hometown. About a year later, I ran into Kiehne on the elevator. He treated me like I was the rock star in that elevator car, and even asked about my family members. By name.

Having received such unwarranted generosity so early in my career, I’ve since made it a habit to simply ask to meet with interesting people—and to answer affirmatively as often as possible to the requests I receive.

Sometimes, we just have to be open to free help. The only cost is laying down our pride or penchant for individualism.

P.S. Ernie Kiehne lived and worked and kept spreading the love into his 90s, passing away in 2010.

2) Take Advantage of Free Educational Resources

Sure, there’s plenty of “freemium” content on the internet worth little more than we pay, and plenty that fits the no-free-lunch stereotype as marketing bait. BUT, there’s also a ton of free or nearly-free content that could be the basis of your next evolutionary step.

For example:

One of the most popular courses in the world is Harvard’s CS50: Introduction to Computer Science. For $219, you can take the class and receive a certificate; or for ZERO dollars, you can audit the 12-week course.

Or check out Stanford’s extensive free online course options, including “Physics-Based Sound Synthesis for Games and Interactive Systems.”

And you can find an endless free course list from top universities and companies on EdX.org or ClassCentral.com.

3) Leverage AI and Digital Tools

Without question, the free (or nearlyfree) lunch I’ve benefited from most over the past year comes from my 24/7 learning, research, and development partners: Claude, ChatGPT, and Gemini.

I prefer the nearly-free versions that let me customize inputs and outputs to maximize computational capabilities, but I genuinely couldn’t pay someone a six-figure salary to be as effective a research assistant as I’ve found well-trained AI agents to be.

3 Ways To Give Free Lunches

And yet, it’s quite possible that the most substantial benefits to be gained from free lunches come not through their consumption, but their delivery. While I don’t believe anyone can claim to know the right or wrong ways to do this, we have received some evidence-based guidance on how to do it most effectively.

1) Give Strategically

In his best-selling book Give And Take, Adam Grant examines three workplace archetypes: Givers, Matchers, and Takers.

Perhaps you won’t be surprised that Givers tend to be the highest performers long-term. But they’re also the lowest performers!

Grant splits givers into “selfless givers”—who give regardless of circumstances, say yes to everything, and are most prone to burnout—and “otherish givers” who care about benefiting others but also maintain their own goals and balance.

While finding this balance is often learned through experience (as we intuit which giving opportunities have more mutually generative power), a great way to develop this habit is to calendarize your giving. Set aside specific times each week dedicated to literally taking someone to a free lunch or coffee—perhaps baking these into your Calendly or calendar management system.

2) Give Without The Expectation Of Reciprocity

While our first point acknowledged that the most effective giving isn’t mindless, it doesn’t change the fact that optimal giving is done without expecting reciprocity.

“If we create networks with the sole intention of getting something, we won’t succeed,” says Adam Grant. “We can’t pursue the benefits of networks; the benefits ensue from investments in meaningful activities and relationships.”

There’s another benefit to this free giving: we don’t waste mind space on a giving “scorecard.” Keeping track of who owes us something isn’t a giving mindset, but a matching mindset that often devolves into taking.

Perhaps there’s something to the spiritual guidance passed down through millennia: give freely as you have received freely.

3) Give In Ways That Create Compound Returns

“Whereas success is zero-sum in a group of takers,” Adam Grant continues, “in groups of givers, it may be true that the whole is greater than the sum of the parts.”

How? Check out this mic-drop conclusion:

“Research shows that people tend to envy successful takers and look for ways to knock them down a notch. In contrast, when givers win, people are rooting for them and supporting them rather than gunning for them. Givers succeed in a way that creates a ripple effect, enhancing the success of people around them.”

Mo Bunnell, a business development consultant and author of Give To Grow, summarizes it thusly:

“A great deal might make your year, but a great relationship can make your entire career.”

One of the best “free lunches” I’ve given or received is a personal introduction. This natural compounding costs $0.00.

Conclusion

What is it about us that seems to want to claim everything we’ve benefited from in life as something we’ve earned?

I’m reminded of a quote from the late Dallas Willard, former Director of the School of Philosophy at the University of Southern California:

“Grace is not opposed to effort, it is opposed to earning. Earning is an attitude. Effort is an action.”

We all need grace, don’t we?

Consider this final encouragement from David Whyte in his poem, What To Remember When Waking:

You are not a troubled guest on this earth,

you are not an accident amidst other accidents

you were invited from another and greater night

than the one from which you have just emerged.”

What would you think of offering—and asking for—a free lunch in the week to come?

NWWW Podcast (New!)

A Cold Call And A Life-Changing Invitation

In this week’s episode, Tim shares the story of a cold call that changed his career—and why having the audacity to ask for help opened doors he never imagined.

Why the “no free lunch” maxim misses a crucial truth

The danger of dualities (thanks to Richard Rohr and David Whyte)

How a college student’s naïve phone call led to a job

Quote O' The Week

Brené Brown is a research professor at the University of Houston who has spent over two decades studying courage, vulnerability, shame, and empathy. Her 2010 TEDx Houston talk, "The Power of Vulnerability," is one of the top five most-viewed TED talks in the world with over 60 million views. She's the author of six #1 New York Times bestsellers, including Dare to Lead and The Gifts of Imperfection.

Weekly Market Update

For the second straight week, small, value, and international companies outpaced the big dogs:

- 0.10% .SPX (500 U.S. large companies)

+ 2.14% IWD (U.S. large value companies)

+ 2.07% IWM (U.S. small companies)

+ 3.32% IWN (U.S. small value companies)

+ 3.30% EFV (International value companies)

+ 1.79% SCZ (International small companies)

- 0.00% VGIT (U.S. intermediate-term Treasury bonds

More Stocks Beating The Index

Contributed by Tony Welch, CFA®, CFP®, CMT, Chief Investment Officer, SignatureFD

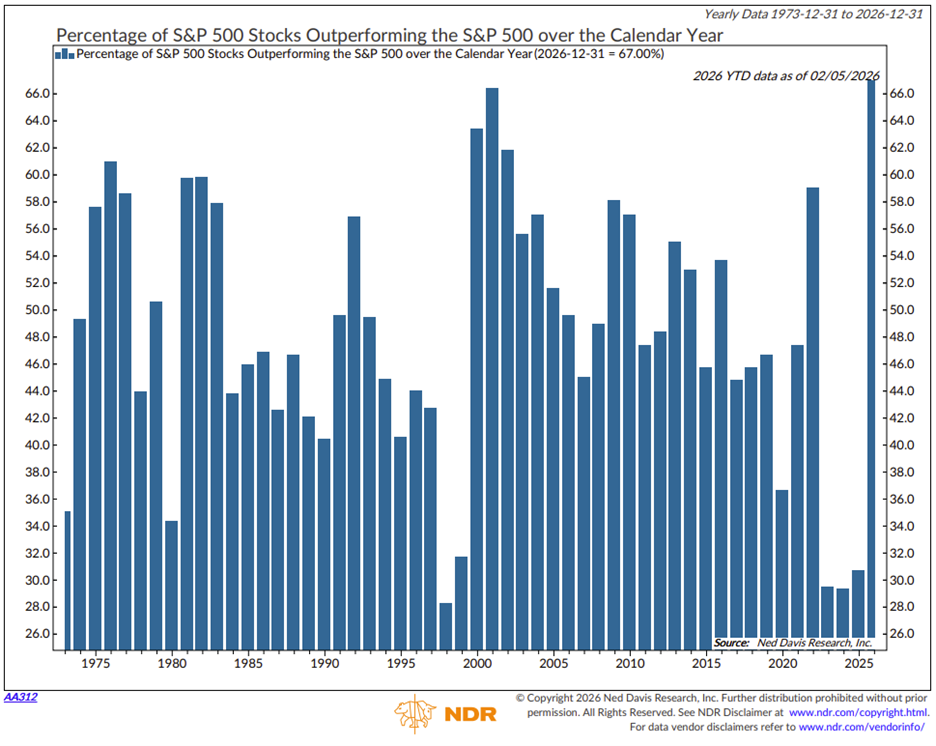

After several years where stock selection offered little reward, owing to a select set of megacap U.S. stocks driving the majority of the environment has shifted meaningfully. In 2026, a growing share of S&P 500 stocks are outperforming the index itself, a clear signal that market leadership is broadening.

When Ned Davis Research first highlighted this trend in late January, roughly 62% of S&P 500 stocks were beating the index, one of the highest readings since the early 2000s. Updated data shows that figure has continued to climb, reinforcing that this is not a short-lived rebound but an improving participation trend.

Historically, very high readings can coincide with more mixed outcomes for the index, especially when paired with defensive leadership. More moderate, rising breadth has typically been associated with healthier market conditions. From a portfolio perspective, this shift matters; returns are becoming less concentrated, providing opportunities in smaller companies, international markets, and value-oriented market segments.

In short, this chart does not argue that the bull market is over. It suggests the market is evolving, with leadership broadening beyond a narrow group of names, a constructive backdrop for diversification and selective risk-taking.

Chart O’ The Week

The Message from Our Indicators

Our partners at Ned Davis Research took a look at the importance of inflation’s effect on economic growth and asset performance last week. Economic growth and stock market performance have tended to be stronger when inflation has been below 4%, as it is now. Historically, relatively low inflation has supported lower bond yields, which support both the economy and stock market valuations. Fortunately, their indicators continue to emphasize that the backdrop for inflation is largely benign. Measures tied to disposable personal income and unit labor costs suggest future inflation could be close to the Federal Reserve’s longer-term objectives than recent headline numbers might imply. At the same time, NDR highlights some countervailing risks. The sharp decline in the U.S. dollar and firmer commodity prices introduce the potential for stickier inflation, particularly through higher import costs. The takeaway is not a re-acceleration of inflation, but rather a slower and uneven path lower, not likely to be a headwind for investors.

Labor market data reinforce an economic moderating narrative. Job openings have declined to their lowest level since 2020, the ratio of openings to unemployed workers continues to fall, and hiring plans have softened. Layoff announcements have increased, particularly in larger firms, although actual jobless claims remain within historical ranges. Labor demand appears to be cooling, which typically dampens wage growth and reduces inflation pressure, even if the unemployment rate itself rises only gradually.

That softer labor backdrop is increasingly visible in consumer sentiment. The University of Michigan’s preliminary February survey showed sentiment essentially unchanged from January and still very low by historical standards. Importantly, confidence gains remain concentrated among households with significant stock market exposure, while sentiment for consumers without equities remains depressed. Concerns about job security and the erosion of purchasing power from elevated prices persist, even as year-ahead inflation expectations eased modestly to their lowest level in over a year.

From a trend perspective, there has been a sustained rotation away from the large Tech names that have driven the majority of index gains since the launch of ChatGPT in 2022, and into other market segments like Value stocks, international markets, and small caps. Market breadth has improved, but that does not necessarily mean that headline index gains will be strong. If the rotation persists and megacap stocks struggle, smaller market segments can rally while cap-weighted indexes like the S&P 500 struggle to gain traction. For now, we give the bull market the benefit of the doubt owing to contained inflation, stable interest rates, solid earnings, and positive economic growth. But we are cognizant of a weakening labor market.

Enjoy the Super Bowl tonight! (I think you probably know who I’m not rooting for.)

Tim