Waiting Wisely: Cultivating Character Amid Market Chaos

University of Southern California professor and storytelling sage Robert McKee said this about character:

“True character is revealed in the choices a human being makes under pressure—the greater the pressure, the deeper the revelation, the truer the choice to the character's essential nature.”

Now, you may wonder how I will bridge from something as profound as character-building—or, indeed, revelation—to personal finance, or whether that is simply a bridge too far. But I assure you that it is not.

Because personal finance—and especially investing—is more personal than it is finance, market volatility is not just a financial hurdle, but a personal one. Therefore, we’ll talk about how to use the current market crisis to refine both your portfolio, and your character.

Meanwhile, Tony will update us on what our indicators are telling us about the market this week, along with insight into Balancing The Economy.

Thanks for joining us for this week’s FLiP, and we hope you and yours have a very happy Easter!

Tim

Tim Maurer, CFP®, RLP®

Chief Advisory Officer

In this FLiP weekly you'll find:

Financial LIFE Planning:

Cultivating Character Amid Market Chaos

Quote O' The Week:

Miles Davis

Weekly Market Update:

Balancing The Economy

Financial LIFE Planning

Cultivating Character Amid Market Chaos

Because all personal hurdles, stressors, and challenges reveal our character, it is entirely possible to use this exercise in financial management as an opportunity for personal growth. Here’s how.

1. Assess

But there’s a catch. We don’t grow simply by going through the tough stuff in life. (Wouldn’t that be nice?) 19th-century novelist, James Lane Allen, wrote, “Adversity does not build character, it reveals it.” So, I’m curious: what has this most recent bout of market volatility revealed about you? What is your assessment?

Were you stressed?

Were you losing sleep?

Did you labor over going to cash?

Did you argue with anyone over that decision?

Did you go to cash?

Please know that if you did any of these things, I’m not suggesting that you lack personal character—that’s where our metaphor falls off, as all eventually do—but your answers to the above questions do tell us something about the appropriateness (or lack thereof) of your current portfolio and your understanding of it.

2. Integrate

Once we’ve taken a moment to observe how we reacted to this most recent bout of upheaval—in this case, a market whipsaw—and the appropriateness of our posture or portfolio is revealed, we have an opportunity to integrate that new information into our consciousness.

This is the step that we most often skip. Typically, we go from stimuli to response—from emotion to action—but our ability to pause, reflect, and integrate separates us, as humans, from the remainder of the animal kingdom. Here’s an integration approach informed by the science of mindfulness:

Refrain. Pause. Yes, however obvious, this is the first step in allowing our System 1 (emotional) processor in our brains to disengage and our System 2 (rational) processor to take over. And yes, breathe. While we take somewhere between 17,000 and 30,000 unconscious breaths throughout a day, the decision to take even just one conscious breath—or 1.5, really—takes only a few seconds and can lead to reduced stress and better decision-making.

Reflect. Observe your feelings and reactions from an objective perspective. Do they align with your values, goals, and long-term objectives?

Reframe. With the benefit of your reflection, identify opportunities for growth and ways to reinterpret the stressors you just faced to improve the possibility of responding more preferably in the future.

3. Activate

Again, the mere fact that we’ve encountered stressors doesn’t mean something’s wrong with us. It’s entirely natural to respond to market volatility in an adverse way—we were wired that way for good reason (self-preservation). Therefore, for many successful investors, and perhaps for you—if you already have a well-diversified portfolio designed to accommodate your willingness, need, and ability to take risk—the best action to take may be inaction.

As the late (and truly great) Charlie Munger said, “The big money is not in the buying and the selling, but in the waiting.”

However, if you find enough of a disconnect between your person and your portfolio, an entirely wise course of action may be to revisit, adapt, and then activate a change.

4. Pursue

You may notice that our process seems to have concluded after the completion of its third step—so why the fourth? Because the point of life is not to manage your portfolio; the point of your portfolio is to fund a better life. Therefore, while our instinctive brain would only require two of our four steps—the first and the third, an instantaneous assessment and immediate reaction—our process has evolved to also require step two so that we can enjoy a potentially better step four.

For Example

Would you like to see a real-life version of this process that played out in real time over the past couple weeks of market craziness?

One of my favorite financial advisors shared an anecdote from one of her treasured clients. After a couple days of market bludgeoning in the middle of the Tariff Tantrum, her clients, who had implemented a sound portfolio plan, called her to say that they simply couldn’t take the market volatility and needed to go to cash in one account that represented a material portion of their overall net worth.

The advisor did her best work to help them navigate a process not unlike the one we described above, only to have the clients conclude that they did, indeed, want to eliminate the risk and heartache of any further market losses and sell everything in that one account, which they did.

Then, in a rare example of John Lennon’s “instant karma,” the market snapped back to recover much of its recent losses in only one crazy trading day. While this great advisor and I would surely caution anyone that this rapid reaction is not to be the expectation, the client reflected wisely on this momentary lesson and reached out to the advisor to let her know that they now understood her guidance and would like to submit themselves to whatever wisdom she would now recommend employing.

As Miles David said, “If you hit a wrong note, it’s the next note you play that determines if it’s good or bad.”

Conclusion

Life rarely offers us such immediate feedback. Many of the lessons we learn—in life and investing—take years to unfold. But the upside I submit as only my opinion, is that the longer the refinement process, the greater the rewards, and deeper our character is formed.

Or, as Søren Kierkegaard wrote, “Patience is the first and patience is the last, precisely because patience is just as active as it is passive and just as passive as it is active.”

Quote O' The Week

The inimitable jazz legend, Miles Davis, gives us some of the best advice, in investing and in life:

Miles Davis

“If you hit a wrong note, it’s the next note you play that determines if it’s good or bad.”

Weekly Market Update

Large cap U.S. stocks continued to struggle this week, but small and international companies did their part:

- 1.50% .SPX (500 U.S. large companies)

+ 1.65% IWD (U.S. large value companies)

+ 2.63% IWM (U.S. small companies)

+ 3.01% IWN (U.S. small value companies)

+ 6.28% EFV (International value companies)

+ 5.97% SCZ (International small companies)

+ 0.58% VGIT (U.S. intermediate-term Treasury bonds

Balancing The Economy

Contributed by Tony Welch, CFA®, CFP®, CMT, Chief Investment Officer, SignatureFD

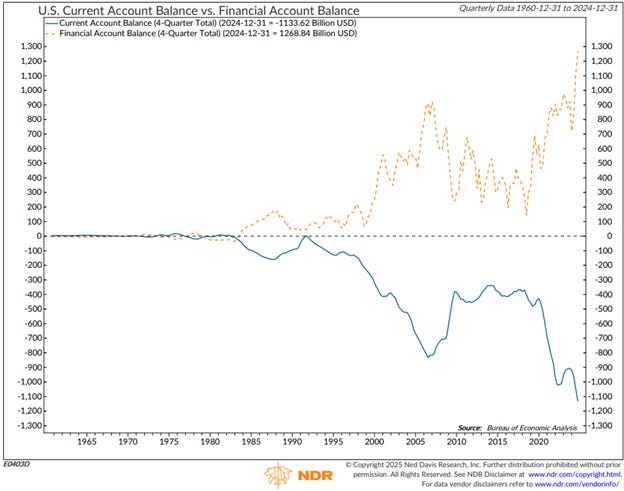

The chart below shows a record current account deficit in the U.S. But it also shows the record financial account surplus. What exactly is going on here? The current account balance is measured as the trade and income differential between the U.S. and other countries. Clearly, the U.S. is importing more than exporting.

The financial account balance is the difference in investment. On that score, the U.S. is a huge exporter of financial assets. So, the U.S. is importing goods, exporting dollars, and those dollars are being recycled back into U.S. financial assets like Treasurys and stocks.

Interestingly, the economy was balanced between the current account and financial account before the mid-80s. Our friends at Ned Davis Research have been pondering the questions – what effect has the growing current account deficit and financial account surplus had for investors? And, what might be the effect of rebalancing the economy? Investors should consider big mega trends like this for long-term portfolio construction.

It is not black and white, but generally, an influx of capital from foreigners has boosted demand for U.S. assets which has likely resulted in lower interest rates, a stronger dollar (helping to keep inflation muted), and higher equity valuations. In fact, they went back and looked at the “balanced” economy period from 1960 to 1980 and found that inflation was higher, earnings were strong, but stock returns were weaker. If the economic rebalancing turns into a structural trend (lasting 10+ years) we need to consider that inflation and interest rates could be structurally higher, and the dollar may be weaker. Investing in that regime would be quite different than in the prior few decades.

The Message from Our Indicators

Last week, retail sales beat expectations, coming in at 1.4% for the month of March. The figure was skewed by a very large jump in autos, which rose 5.3% in the month. That’s interesting as autos are quite exposed to tariffs. It would appear that consumers pulled forward the purchase of a car ahead of tariffs. We would like to see follow through in the retail sales numbers for April and May when tariff impacts are more likely to show up. But what this tells us is that the consumer is likely in pretty good shape heading into the new levies. Survey data remains something of a concern. Most recently, last week the Philly Fed Manufacturing Survey plunged to -26.4, its second lowest reading since the pandemic shutdown. For now, the survey data appears more dire than the actual hard data but that can only occur for so long. The longer that sentiment remains depressed, the greater the chance that it funnels through to a contraction in actual activity. For now, the macro message is still bullish as credit conditions remain solid and rates have been rangebound, but the range of outcomes from an economic perspective is widening.

From a fundamental perspective, earnings season is off and running and has been solid so far. 59 of the S&P 500 companies have reported and thus far the earnings growth rate has come in at 9.2% on sales growth of 6.1%. That implies that at least in Q1, companies continued to see some profit margin expansion. That’s encouraging as they may be in a decent position to absorb some increased costs associated with tariffs. Valuations have improved given the stock market corrections, but we still wouldn’t consider domestic large cap Growth stocks “cheap.” We continue to think diversification is the primary theme for 2025.

From a technical perspective, the market has been tracing out a traditional bottoming process. Historically, corrections play out in four phases – an initial sell-off, a relief rally, a secondary bout of weakness, and a breakout rally. We think we’re somewhere between phase two and three today. Sentiment certainly got to levels that have historically marked major market lows. So while we think volatility will continue, in the absence of an outright recession, we believe the most volatile days may now be behind us.

But the rest of your Easter Sunday is still ahead of you, so please enjoy it!

Tim