Wealth Remembered

An Unexpected Sonnet For The New Year

I was unintentionally drawn back to 1992 in this first full week of 2026, to my 11th grade English class and Mr. Caretti, the most influential teacher I had, well, maybe ever. Mr. Caretti had the misfortune of teaching me English for three of the four years of high school, and sadly, it wasn’t until several years after I graduated from college that I fully appreciated his influence.

In this week’s Financial LIFE Planning section, I’ll tell you the rest of the story and share a reflection dating all the way back to (roughly) 1595 that I hope will help you see your financial situation in a more positive light, regardless of the numbers denoting your net worth statement.

Then, following a powerful quote from one of the foremost poets of the 20th Century (Jimi Hendrix), Tony asks a compelling question that betrays the notion that we shouldn’t talk about money or politics: “Could This Midterm Year Be Different?”

Thanks for joining us for our first edition of the Net Worthwhile weekly in 2026!

Tim

Tim Maurer, CFP®, RLP®

Chief Advisory Officer

In this Net Worthwhile® Weekly you'll find:

Financial LIFE Planning:

Wealth Remembered

Quote O' The Week:

Jimi Hendrix

Weekly Market Update:

Could This Midterm Year Be Different

Financial LIFE Planning

Wealth Remembered

An Unexpected Sonnet For the New Year

It was in the 11th grade, indeed, that the contrast between my English teacher, Mr. Caretti’s, passion for the written word and my pursuit of the degenerate I-don’t-give-a-you-know-what aura reached its zenith.

Lest you think I’m exercising hyperbole, let me give you an example of the hijinks in which my unnamed compatriot—Bard, we’ll call him—and I would engage.

Bard and I would regularly choose a “word of the day,” and whenever that word was spoken in class, we would simultaneously stand up and sit back down. Simple, but hysterical (we thought). And while it may seem like one of the more harmless high school pranks, imagine putting yourself in the shoes of the teacher for a moment, especially if the word was more common.

On one such day, our laziness with the word “the” led to so many ups and downs that Mr. Caretti finally lost it. Standing with an outstretched arm pointing toward the classroom door, Bard and I were ejected from class. On another day, we were ejected before class even started on the simple basis that Mr. Caretti had a migraine headache. (While we hadn’t even misbehaved yet, I’m sure we were going to.)

But on most days, Mr. Caretti’s patience would outlast our deviance. And even though I wouldn’t admit it for at least a decade,

I

was

listening.

He would regularly stand in front of the class and read a passage of prose or poetry. And I would never—could never—forget seeing him brought to tears by an arrangement of words so beautiful that he was forced to forget the apathy I wore as armor against the deeper discovery those words were bound to compel.

And eventually they did, especially after Bard and I learned that Mr. Caretti died of cancer, at the age of 66, forcing a deeper level of reflection and appreciation on the impact he’d had.

This appreciation has been reborn many times since, including this past week when I listened to a recitation by David Whyte of Mr. Caretti’s favorite author of all time, the original bard, himself. Will you consider Sonnet 29 by Shakespeare with me to kick off the New Year?

Sonnet 29, William Shakespeare

When, in disgrace with fortune and men’s eyes,

I all alone beweep my outcast state,

And trouble deaf heaven with my bootless cries,

And look upon myself and curse my fate,

Wishing me like to one more rich in hope,

Featured like him, like him with friends possessed,

Desiring this man’s art and that man’s scope,

With what I most enjoy contented least;

Yet in these thoughts myself almost despising,

Haply I think on thee, and then my state,

(Like to the lark at break of day arising

From sullen earth) sings hymns at heaven’s gate;

For thy sweet love remembered such wealth brings

That then I scorn to change my state with kings.

And why did I think this was worth your attention? Here are a few reasons that could help reshape your perspective on wealth:

First, it seems that every new year brings with it an unspoken competition to compare. Whether to compare our previous year’s accomplishments, milestones, or holiday cards, or the current year’s aspirations, dedications, or resolutions, we can all find something that we lack enough to inspire an “outcast state.”

We need not look far to find one who appears “more rich in hope” or with an apparent surplus of “friends possessed.” (Good Lord, how could Shakespeare have known that the most powerful and profitable influences of our age would be means and mechanisms that literally count and broadcast our very specific number of “friends” and “followers” with the thinly veiled intent to inspire envy!)

Indeed, it takes only seconds to find what we most enjoy “contented least,” if that is what we are looking for. But if in these inevitable moments when we’re invited into self-sabotage, we ruminate instead on our “thee”—whatever that be—it can (and must) cause us to remember just how wealthy we really are.

Because true wealth is so much more than a number. Any number. And you get to define it. This year, and every year.

And is it possible that, like the poet, the wealth we seek (like the lark) is already there, and all we need to do is remember it?

NWWW Podcast

Next week, we’ll discuss Tony’s forecast for 2026, but for this week, please check out the year-in-review for 2025.

Quote O' The Week

Soft-spoken and shy, Jimi Hendrix let his music do the talking—and in just four years of recording, it said more than most musicians manage in a lifetime.

Weekly Market Update

Markets were up to way up this week for the first full market week of the New Year:

+ 1.57% .SPX (500 U.S. large companies)

+ 2.54% IWD (U.S. large value companies)

+ 4.60% IWM (U.S. small companies)

+ 4.51% IWN (U.S. small value companies)

+ 0.44% EFV (International value companies)

+ 2.65% SCZ (International small companies)

+ 0.05% VGIT (U.S. intermediate-term Treasury bonds

Could This Midterm Year Be Different?

Contributed by Tony Welch, CFA®, CFP®, CMT, Chief Investment Officer, SignatureFD

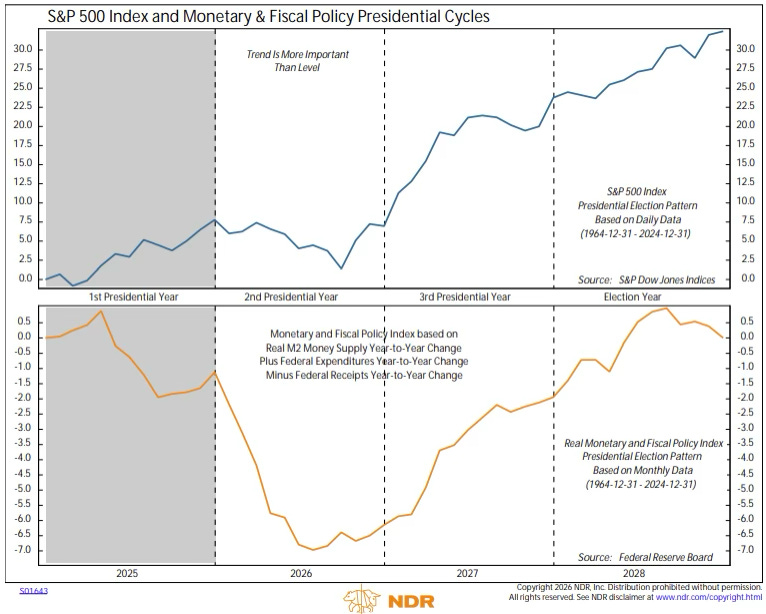

Historically, midterm election years have been the most challenging for U.S. stocks in the four-year presidential cycle. In fact, the market has barely averaged a gain and tended to see double-digit corrections into the Fall. The pattern is not random. Rather, it can be explained by the corresponding pattern in monetary and fiscal policy. The chart below shows the average trend for the S&P 500 Index in blue, throughout the four years in a presidential term. The bottom clip, in orange, shows the pattern of monetary and fiscal stimulus. Note that in the second year, the policy has tended to be quite restrictive before ramping up in year three ahead of the reelection campaign. But that is far from the pattern we expect this year.

The Fed is currently projecting one rate cut, and market expectations are more aggressive at three. Regardless, the Fed has an easing bias heading into this year. And fiscal policy is set to turn higher, as well as the effects from the One Big Beautiful Bill Act begin to kick in. Rather than tight policy, we expect a relatively easy policy framework, implying that the traditional cycles may not hold this year.

Does that mean that correction risk is off the table? No. Valuations are relatively stretched, putting the onus on corporate earnings to drive market returns this year. We expect earnings to maintain a positive trajectory, but there is always the possibility that fundamentals disappoint. Additionally, there remains some policy uncertainty as the midterm elections are likely to be tightly contested. The major takeaway is that there could be risks, but the traditional risk of tight fiscal and monetary policy is not likely to be one of them.

Chart O’ The Week

The Message from Our Indicators

The latest economic data paint a picture of an economy that is slowing but not breaking. Friday’s employment report showed payroll growth of about 50,000 jobs in December, a clear step down from earlier in the year. At the same time, the most important measures watched by the Federal Reserve actually improved. The unemployment rate dipped to 4.38%, its lowest level since August, and the prime-age employment rate ticked up to 80.7%, both signs that the labor market still has some underlying resilience.

However, job growth is becoming increasingly narrow, with most new hiring concentrated in healthcare. Private payrolls outside that sector have contracted in seven of the past eight months. This points to a “low hiring, low firing” environment where companies are cautious but not yet panicking. Layered on top of the domestic data, global headlines are adding to uncertainty. Recent developments in Venezuela, including renewed political tensions and questions around sanctions policy, have the potential to ripple through energy markets and emerging economies, reminding investors that geopolitics can quickly spill into financial markets even when U.S. data looks relatively stable.

On corporate fundamentals and valuations, one of the more important themes right now is simply how expensive U.S. stocks have become. The forward price-to-earnings ratio for the S&P 500 is around 22.8, a level only seen previously during the late-1990s tech bubble and the post-COVID surge in 2020–2021. Over the past three years, stock prices have climbed roughly 91%, while corporate earnings have grown closer to 29%.

That gap between prices and profits helps explain why valuations have expanded so much. Profit margins are currently near record highs, which has helped support those valuations. Still, history shows that margins tend to come down during economic slowdowns and may not provide much protection when the next downturn eventually arrives. It may prove challenging to get any valuation expansion from here, so our expectation would be for 2026 gains to be driven almost entirely by the growth in corporate earnings.

From a market perspective, this helps explain why leadership has started to rotate and why investors are becoming more selective. We are still in a bull market, but it is a more mature one, where gains may slow and volatility shows up more often. Research suggests the labor market is on a gradually worsening trend, which should eventually cool spending and corporate profits, even if that process is slow and uneven. At the same time, the Federal Reserve appears comfortable staying on hold for now.

However, rate cuts are more likely later in 2026 than additional hikes, especially if inflation continues to drift lower and unemployment edges higher. For markets, that combination of slowing growth and a potentially more supportive Fed usually leads to rotations rather than broad selloffs. In this type of environment, diversification and flexibility matter more than trying to make all-or-nothing calls. Leadership can shift quickly, and periods of volatility, often triggered by geopolitical or policy surprises, tend to create both risks and opportunities for patient investors.

No need to refinance this weekend,

Tim