What Do We Really Want Beneath What We Say We Want?

Andy Gullahorn, a gifted singer-songwriter, recently delivered a gift of his own with an unlikely wrapper. Using a provocative metaphor, he asks: “Does it really count as ‘Yes’ without a chance of ‘No’?” His point is philosophical, not salacious—real desire requires the possibility of rejection; satisfaction requires risk.

He concludes, “We think we know what we really want, but what we really want lies underneath,” and that is precisely the topic on my mind:

How do we know what we really want?

I surely don’t know what you really want, but in this week’s edition, I will offer some perspective and an exercise that I believe, if undertaken in earnest, could help you answer that question.

And speaking of questions—Tony (and I) are addressing another big one in this week’s podcast and the Weekly Market Update: Are we facing an AI bubble in the markets?

Thanks for joining us this beautiful fall weekend!

Tim

Tim Maurer, CFP®, RLP®

Chief Advisory Officer

In this Net Worthwhile® Weekly you'll find:

Financial LIFE Planning:

What Do We Really Want Beneath What We Say We Want?

NWWW Podcast (New):

Bubble Talk: Separating Sensationalism from Sound Investing

Quote O' The Week:

George Orwell

Weekly Market Update:

The Changing Face Of Market Leadership

Financial LIFE Planning

What Do We Really Want Beneath What We Say We Want"?

How do we know what we really want?

I believe this question, while rarely asked within the financial planning domain, is actually one of the most important we could ask. Too many financial plans are accidental, unintentional, uninspired, or based on someone else’s answer to the question, “What do we really want?”

The Illusion of Optionality

Plans that are too open-ended tend to provide the illusion of optionality. Psychologist Barry Schwartz’s research on the “paradox of choice” demonstrates that excessive options don’t increase satisfaction—they decrease it. When everything remains possible, people experience more anxiety, more regret, and less confidence in their decisions. Paraphrasing Warren Buffett, you can do anything, but you can’t do everything.

For example, a retirement goal that only consists of two numbers—to have $4,000,000 saved to retire at 65—provides you with plenty of options for precisely what to do when you retire, but because there is no reference to why you’re retiring in the first place and how to spend your time in retirement, the result is a hollow plan.

It’s like you’ve purposed yourself to get a college degree without identifying a major or the job you hope to receive when you get out of college.

You might hit your numbers, but still feel empty because you never defined what the numbers were for.

However momentarily satisfying it can feel to hit our numerical financial goals, lasting satisfaction most often comes from the genuine lived experiences that you hope to fund with your savings, not the saving itself. And that may require closing some doors to enable you to walk more fully through others.

The Purpose Of My Wealth Is…

Research in behavioral economics shows that when financial decisions align with clearly articulated values and purpose, people experience less decision regret, higher satisfaction with outcomes, and better follow-through on their plans. Purpose acts as what researchers call a ‘commitment device’—it defines not just what you’re saving, but what you’re saving for.

While I don’t adhere to an exclusionary doctrine that insists there is only one way to imbue your financial planning with a greater sense of purpose, the simplest I may have found is to consider and answer this question:

The purpose of my wealth is…[fill-in-the-blank].

I’m not inclined to tell you what a good or bad answer is, but it could be a word, phrase, sentence, paragraph, or even a series of photos that illustrates what’s most important in your life.

Of course, one of the challenges with this question is that it, too, can be pretty open-ended, so I created an exercise (below) that allows you to limit the seemingly infinite range of response options to six simple prompts that should help you excavate the raw materials necessary to complete the sentence above, defining your Net Worthwhile®.

Because, as Andy Gullahorn sings, “What we really want lies underneath what we settle for when we don’t believe we could ever have what we really want.”

This post was initially published on Forbes.com.

NWWW Podcast (New)

The word “bubble” has been floating around again, creating fear among investors about market conditions, tech stocks, and AI. In this episode, I sit down with co-host Tony Welch to cut through the sensationalism and examine whether bubble concerns are founded.

We explore markets at three levels—overall markets, technology stocks, and AI specifically—discussing what the fundamentals actually tell us, why concentration in top performers isn’t necessarily alarming, and how real investors should think differently than talking heads on TV.

The conversation also tackles the practical question many listeners face: What to do if you’re sitting on significant gains in concentrated AI positions?

Quote O' The Week

This quote is often attributed to George Orwell (1903-1950), a British novelist and political commentator best known for 1984 and Animal Farm, two prescient explorations of how power corrupts truth.

Weekly Market Update

After a wild Friday, markets ended the week decidedly mixed, with international stocks leading the charge:

+ 0.08% .SPX (500 U.S. large companies)

+ 0.18% IWD (U.S. large value companies)

- 1.71% IWM (U.S. small companies)

- 0.64% IWN (U.S. small value companies)

+ 1.71% EFV (International value companies)

+ 1.05% SCZ (International small companies)

- 0.17% VGIT (U.S. intermediate-term Treasury bonds

The Changing Face Of Market Leadership

Contributed by Tony Welch, CFA®, CFP®, CMT, Chief Investment Officer, SignatureFD

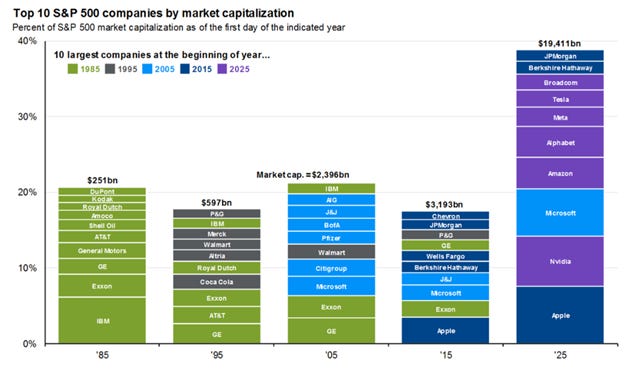

This week’s chart highlights how the composition of the top 10 companies in the S&P 500 has evolved over time. In 1985, the list was dominated by industrial and energy giants like Exxon, GE, and DuPont. By 1995, consumer brands such as Coca-Cola, P&G, and Walmart had taken center stage. A decade later, in 2005, financials like Citigroup and Bank of America were among the largest. Fast forward to 2025, and technology and platform companies, such as Apple, Microsoft, Nvidia, Amazon, and Alphabet account for an unprecedented share of total market capitalization.

The lesson here is that markets are dynamic ecosystems, not static structures. Innovation, capital allocation, and creative destruction continually reshape leadership. This is particularly relevant today as investors debate whether the surge in AI-related companies represents a “bubble.” Valuations in the space are elevated, but potentially more importantly, history suggests that leadership shifts are normal and often coincide with major technological inflection points. The internet, smartphones, and cloud computing all sparked similar concerns in earlier cycles before becoming enduring drivers of growth.

Rather than viewing today’s AI-driven market through a speculative lens, it may be more appropriate to see it as part of this ongoing process of evolution. The companies at the top of the index today may not hold those positions forever, but the long-term story of innovation and value creation has been remarkably consistent. The market’s top 10 may change, but progress itself endures.

Chart O’ The Week

The Message from Our Indicators

Economic data remains noisy as the effects of the government shutdown continue to distort month-to-month readings. Yet, the broader picture still points to a moderating but resilient backdrop as 2025 winds down. Labor market indicators have softened across job postings, wage intentions, and hiring plans, though they remain far from recessionary territory, and weekly claims stay historically low. Small business sentiment has weakened, reflecting slower demand and some pressure on margins, but not enough to signal a downturn.

Meanwhile, central banks continue to lean toward accommodation, and the Fed is expected to follow its recent rate cut with another move in December as it seeks to cushion slowing job creation. Globally, policy remains supportive and the early outlook for 2026 suggests growth that is slower than this year but still positive, assuming monetary and fiscal conditions remain constructive. Historical cycle trends also imply that mid-term election years can be more challenging for markets and economic confidence, a factor worth acknowledging as we look ahead.

On the fundamentals side, the Q3 earnings season is now mature. With 84 percent of S&P 500 companies reporting, sales growth of 8.2 percent and earnings growth of 13.6 percent point to clear margin expansion and healthier profit dynamics than many expected heading into the fall. Management commentary continues to highlight disciplined cost control, strong operating cash flow, and rising investment, particularly in AI-related infrastructure.

This remains an important distinction in the current environment as investors debate whether AI enthusiasm represents a bubble. While valuations are elevated in parts of the market, the underlying cash generation of the largest platform companies offers more fundamental support than typical bubble conditions. As we look toward 2026, earnings breadth will be an important watch point. Even so, with inflation pressures contained and liquidity broadly improving, the earnings backdrop remains constructive.

Technically, markets have experienced some corrective action this week, but that is entirely normal. The average year sees more than three separate 5 percent pullbacks, and nothing in the recent weakness suggests a break in the underlying trend. Risk appetite measures remain broadly consistent with a continuing bull environment, although leadership is beginning to show early signs of rotation as cyclical strength starts to cool. This too aligns with historical tendencies heading into mid-cycle periods. Breadth has softened but not deteriorated, global liquidity conditions continue to improve, and price action remains supportive.

All told, growth is slowing but not stalling, earnings are beating expectations with room to run, and normal corrective behavior should be viewed through a long-term lens. Given these factors, we continue to give the bull market the benefit of the doubt.

One thing that’s not growing any longer is your weekend—so I hope you go enjoy the rest of it!

Tim