What Would You Do If You Actually Believed You Could?

Entrepreneur extraordinaire, Paul Graham, shared a tweet almost a year ago now that I’ve been considering, describing it as “the most inspiring sentence I’ve ever read,” while disclaiming that “it’s not phrased in the way things meant to be inspiring usually are.”

That’s a compelling enough intro from an early-stage investor in some little names like Airbnb, DoorDash, and Reddit, don’t you think?

The sentence referenced is the centerpiece of this week’s Financial LIFE Planning post, before Tony gives us a look ahead into the New Year to come. (Yep, it’s almost here, whether we’re ready or not!)

Thanks for making us a small part of your weekend!

Tim

Tim Maurer, CFP®, RLP®

Chief Advisory Officer

In this Net Worthwhile® Weekly you'll find:

Financial LIFE Planning:

What Would You Do If You Actually Believed You Could?

NWWW Podcast:

Taking Back Your Agency As An Investor

Quote O' The Week:

Seneca

Weekly Market Update:

Looking Ahead To The 2026 Cycle Composite

Financial LIFE Planning

What Would You Do If You Actually Believed You Could?

The sentence that Paul Graham quoted as the most inspiring he’s ever read came from Nick Cammarata, an AI safety researcher at OpenAI, who initially tweeted the following:

i hate how well asking myself “if I had 10x the agency I have what would i do” works

Interesting, isn’t it, how so many of us yearn for more control, more opportunity, more agency—over our lives, our work, our money—but we don’t actually act like it? And what would happen if we did?

But first, let’s consider why we often don’t.

The Forces Holding You Back

We seem to have an active preference for inactivity, even when the alternative may be to our benefit.

Passivity and inaction are actually the brain’s default state. Status quo bias suggests that we “prefer things to stay the same by sticking with a decision made previously…even when only small transition costs are involved and the importance of the decision is great.”

Um, why?

It appears there are a handful of potential competing possibilities:

The sunk cost fallacy leads us to stick with an existing plan, even when it’s suboptimal, because we want to validate the decision we made in the first place. It’s why we’ll keep watching a crappy movie because we paid for the tickets and bought the popcorn.

Regret avoidance and loss aversion are powerful forces in our brains. We are driven more by a fear of losing than by the anticipation of winning, by a ratio of at least 2-to-1.

And cognitive dissonance—the challenge of holding two opposing thoughts in our minds—often leads to analysis paralysis. Therefore, more often than not, most simply choose not to choose.

Even more fascinating, this tendency towards passivity ultimately shapes our very perspective of the future and what is possible, or not. “Young people, middle-aged people, and older people all believed they had changed a lot in the past but would change relatively little in the future,” according to a study by Quoidbach, Gilbert, and Wilson. And check out their conclusion: “People, it seems, regard the present as a watershed moment at which they have finally become the person they will be for the rest of their lives.” (Emphasis added, because I thought it was deserving.)

Wow. Gilbert further mused, “What we never seem to realize is that our future selves will look back and think the very same thing about us. At every age, we think we’re having the last laugh, and at every age, we’re wrong.”

How’s Your Locus Of Control?

But obviously not everyone acts this way, right? Because we see people every day in the headlines—people like Paul Graham and Nick Cammarata, actually—who, despite their natural instincts to play it safe, choose to do otherwise. Sometimes they fail, of course, but other times they succeed, and in so doing create the very future that we all live in the present.

Locus of control “refers to how much power people believe they have over their lives and the things that happen to them.” Having a high internal locus of control suggests that you believe you have more control, while having an external locus of control means that you don’t believe you have the ability to change your circumstances. At its extreme end, this is referred to as learned helplessness.

But here’s the good news: “People with a high internal locus of control tend to perform well academically, achieve more professionally, act more independently, are healthier, are better able to cope, and experience less depression than their externally oriented counterparts.”

Seems to make a pretty strong case for choosing action over inaction—choosing to take the well-informed risk over our innate default to apparent safety?

The Real-Life Application Of Our Imagination

And this is where Cammarata’s hypothetical becomes particularly powerful, because it seems like it’s a big enough challenge for us humans to imagine that we do have control, much less that we have 10 times more control than we even think we do!

But what if we could? What if we should? What if we did?

What could happen then? Dr. Hal Hershfield has done some inspiring work, helping us understand the powerful role that our imagination can have in both understanding and shaping our future selves, partly through the recognition that we are ever-changing, and therefore benefit from connecting with both our past self and our future self:

“If you feel a strong connection between your present and future selves—even though your present self is different from your past self, and your future self will be different from who you are today—you are much more likely to perform the hard work of self-improvement.”

Hershfield suggests using our imagination to envision our future self as an aid for the important task of saving for our eventual retirement, a task that we have found very challenging as humans.

But what if we used this method, as we’re staring down the barrel of another New Year, and asked ourselves the question initially posed by Nick Cammarata—not simply, what if we had agency over our future…but what if we had 10 times the agency, what would we do?

What would you do?

The research says you’ll probably underestimate how much you’re capable of changing. Which means whatever answer you come up with? It’s likely too small. So let’s keep asking and imagining.

NWWW Podcast

In this week’s podcast episode, Tony and I talked about how we can take a greater sense of agency in a pursuit that is often dominated by feelings of a lack of control—investing.

Quote O' The Week

Seneca was a Roman Stoic philosopher, statesman, and advisor to Emperor Nero, whose writings on how to live well under difficult circumstances have remained remarkably relevant for two thousand years.

Weekly Market Update

While the S&P dipped a little this week, our small, value, and international indices all hit 52-week highs:

- 0.63% .SPX (500 U.S. large companies)

+ 0.63% IWD (U.S. large value companies)

+ 1.23% IWM (U.S. small companies)

+ 1.99% IWN (U.S. small value companies)

+ 1.57% EFV (International value companies)

+ 0.49% SCZ (International small companies)

- 0.10% VGIT (U.S. intermediate-term Treasury bonds

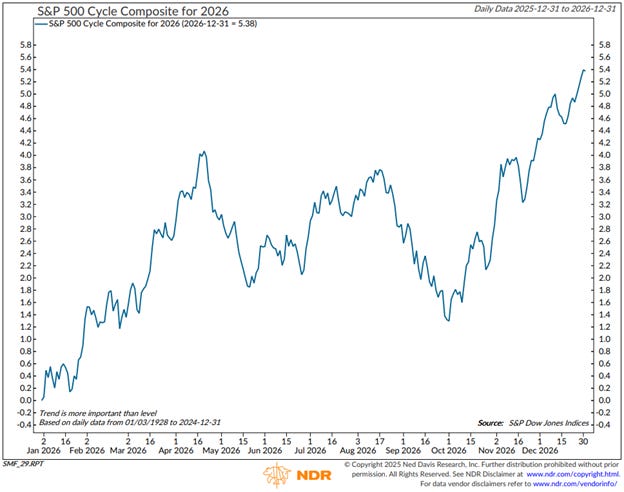

Looking Ahead to the 2026 Cycle Composite

Contributed by Tony Welch, CFA®, CFP®, CMT, Chief Investment Officer, SignatureFD

Ned Davis Research’s 2026 S&P 500 Cycle Composite points to a familiar but uneven pattern for the year ahead: strength early, weakness in the middle, and a constructive finish. The composite blends three long-running historical influences – the one-year seasonal cycle, the four-year presidential cycle, and the ten-year Juglar (intermediate-term business) cycle – and suggests an uptrend carrying into late Q1 or early Q2, followed by a choppier and weaker Q2–Q3 period, before a year-end rally takes hold. Importantly, NDR emphasizes that with cycle analysis, the trend matters more than the precise magnitude, making the sequencing of returns more informative than point estimates.

What makes the mid-year caution notable is the role of the four-year cycle. Mid-term years have historically been the weakest of the presidential cycle, as monetary and fiscal policy often remain relatively restrictive until closer to the next election cycle. In 2026, NDR highlights two potential wildcards that could either reinforce or disrupt this historical script: how markets digest a new Fed chair and how investors interpret the impact of fiscal stimulus tied to the One Big Beautiful Bill Act. Near-term, however, the message is clearer. The cycle composite aligns with NDR’s broader U.S. equity and asset allocation models in signaling that the current uptrend likely extends into early 2026, even if patience is required through what history suggests could be a more volatile middle stretch of the year.

Chart O’ The Week

The Message from Our Indicators

The Fed delivered the widely expected 25 basis point rate cut last week, bringing the target range to 3.50%-3.75%, a total of 175 basis points of cuts since the easing cycle began. Chairman Powell indicated the Fed is now at the “upper end of neutral” and will evaluate policy meeting-by-meeting based on incoming data, leaving the door open for another cut in January.

Small business optimism picked up in November, though hiring plans remain subdued. More encouragingly, employment costs are moderating, with the latest reading showing the slowest wage growth since Q2 2021. However, inflation pressures bear watching. More small businesses raised prices in November than at any time since March 2023, partly due to tariff-related supply chain challenges. On the positive side, the trade deficit shrank to its lowest level since June 2020, which should boost Q3 GDP, though the Conference Board’s Leading Economic Index continues pointing to slower growth ahead.

The market trend remains bullish and has shown some encouraging signs. We recently saw strong participation around Thanksgiving, which suggests potential for a year-end rally. Additionally, seasonal trends are supportive. The second half of December has historically been the strongest half-month of the year, with average gains of 1.4%, and that strength typically carries through January. From a sector perspective, Technology is entering its most bullish seasonal stretch, showing the highest average return among all sectors during the December 15-February 15 period, while defensive sectors like Consumer Staples, Health Care, and Utilities have typically underperformed around the start of new calendar years.

Recent currency trends are also notable. The dollar has fallen to its lowest levels since October, with both the Japanese yen and British pound showing improving strength. A weaker dollar is supportive of international stock leadership.

All told, the message from our indicators remains constructive and in line with a continuation of the bull market into 2026.

Hoping your as optimistic as those small businesses this weekend!

Tim

Brilliant. Agency thinking, a profound heuristc.