“Do I Have Broccoli In My Teeth?” How To Give—And Receive—Advice Better

In a Harvard Business Review study, 155 people were put in a position where the survey administrators rolled into the room with either food or marker on their faces. How many of the participants do you think spared the administrators further embarrassment by letting them know?

4.

Not even 4%. Just 2.6% of the participants had the guts, grit, or grace to tell these poor survey administrators that they had food on their faces. They let them walk right out the door.

Which begs the question: Do we—do you—want to know if you have broccoli in your teeth? I’m pretty sure that number will always be 100%, so why are we so unlikely to offer the courtesy we so desire to receive?

This week, we’ll talk about why we withhold advice and offer 5 ways to give advice better, along with 5 ways to better receive advice. Tony and I talk through this concept, with a couple funny anecdotes to boot on this week’s podcast, and Tony also walks us into earnings season in this week’s Weekly Market Update.

Thanks, as always, for choosing to spend a few minutes of your weekend with us!

Tim

Tim Maurer, CFP®, RLP®

Chief Advisory Officer

In this Net Worthwhile® Weekly you'll find:

Financial LIFE Planning:

“Do I have broccoli in my teeth?”

NWWW Podcast:

Why Helpful Advice Often Goes Unsaid

Quote O' The Week:

Kim Scott

Weekly Market Update:

Earnings Season & Margin Watch

Financial LIFE Planning

How To Give—And Receive—Advice Better

So, why would we withhold advice, even when it’s helpful?

A couple things here may be self-evident. For example, there’s no denying that interrupting an interaction, especially in its most formative stages (aka, before the first round of drinks have been consumed), can feel awkward. And we may well fear that the beneficiary of our quiet alarm will take it the wrong way.

But another similar study—with even more dramatic results (only 1.8% spoke up)—arrived at a more nuanced conclusion, one that can be incredibly damaging in the corporate and organizational space:

We’re even more inclined to hold back on giving advice when it matters most.

Sheesh! That’s scary to think about, isn’t it? But it likely also tracks. Let’s say, for example, that you have an audience with the CEO of your company. Let’s raise the stakes even higher, and say that this is a company “town hall” with the CEO on stage, a regular practice at my firm and many others. All of your colleagues are in the audience. As a subordinate, are you inclined to stand up, challenge an assumption of the person who signs your paychecks, and risk the embarrassment of your peers?

I believe the best CEOs appreciate—even thrive on—that challenge, and the healthiest organizations truly welcome feedback as a gift, but there’s no denying that your smart watch might signal a higher-than-usual heart rate if you muster the courage to speak up.

Or what about your work with clients? As financial advisors, we regularly get the privilege of being the bearers of good, even great, news. But our real greatest value may be in our willingness to let someone know that they’re walking dangerously close to the train tracks.

To tell someone, for example, that you believe they may need to delay or cancel their long-awaited retirement party—or dramatically downsize their standard of living—in order to ensure that they don’t outlive their assets is literally in our job description. But that doesn’t mean it’s easy to speak up.

We will certainly be faced with an emotional response, likely disappointment, and maybe anger redirected at us. We may even risk losing the client and impairing our own livelihood, all despite the fact that it might be the most important piece of advice we ever give that client.

And perhaps that’s part of the problem: Our titles literally have the word “advisor” in them, but the vast majority of education and training we get as financial advisors is financial, not advisory. Personally, I received exactly zero training in the art of advice giving early in my professional life; I had to seek it out through niche thought leaders, like George Kinder, Carol Anderson, Amy Mullen, Dick Wagner, Rick Kahler, and Ted Kontz.

So maybe that’s what we need to do—and say—the right thing at the right time: some advice on advice giving.

5 Ways To Give Advice Better

Please note the order of this heading. It’s not about giving better advice, but about giving advice better. And the goal here isn’t a license to give more, harsher, or unsolicited advice, but simply how to deliver it well. Here’s a short, simple outline to guide us:

1. Take a deep breath (inconspicuously) with a long exhale.

More oxygen helps us speak from a place of rationale, rather than emotion.

2. Start with permission.

“Can I offer something that might help?”

3. Say it like you’d want to hear it.

Calm, caring, clear. My personal coach drills it into my head that, “Clarity is kind,” and she practices it.

4. Focus on care, not correction.

If feedback really is a gift, it should feel like one—not a performance review.

5. Don’t wait too long.

The moment gets heavier the more we delay.

For more on ways to speak up effectively, especially in higher-stakes situations, check out the books Crucial Conversations, Radical Candor, and Supercommunicators.

5 Ways To Receive Advice Better

There is, however, a second side to this coin, because the thing about our blind spots is that we can’t see them. Indeed, we want to know that there is broccoli in our teeth, but that doesn’t mean that we don’t suffer a moment of embarrassment. The big key here: we must be willing to swallow minor embarrassment to avoid a much larger one.

We can better prepare ourselves to receive—and better signal to others that we’re willing to receive—by following these guidelines:

1. Invite it explicitly.

“Please tell me if you see something I might be missing,” opens the door and lowers the social risk, thereby increasing the chance that they’ll say what you need to hear.

2. Respond with curiosity, not defensiveness.

It can’t hurt to start with “Thank you for telling me,” and then consider something like, “Tell me more,” or “Can you help me understand what you observed?”

3. Signal emotional safety.

My wife’s favorite coffee mug says, “I’m not responsible for what my face is telling you,” and I know I’d be embarrassed if I had an instant replay of the last time my bride offered me a helpful corrective. We don’t have to agree—but we do have to signal receptivity—in order to make it safe for others to give us critical counsel.

4. Acknowledge and act on it.

Our first instinct is likely resistance, if not defensiveness, in the face of feedback, but when someone illuminates a blind spot, acknowledging it with gratitude and then following their advice helps us ensure that person (and likely others, in the case of a more public acknowledgement) will be willing to share their wisdom again in the future.

Conclusion

May I offer a confession? I’ve rarely struggled to voice my opinion—you can ask my parents. (I’m an Enneagram 8—Lord help us.) It’s probably one of the reasons I ended up in a field with the word “advisor” in my job title. But it’s taken a lifetime of learning to understand why, how, and when to speak up.

And while most people wisely avoid argumentation, I’ve been known to run toward it. That’s why an even greater challenge—and lesson—for me has been learning how to truly listen. To receive advice well. So I say all of this not as a master, but as a lifelong student of everything I’ve written above.

Which, I think, puts me in a good place to ask you some honest questions:

What’s your version of broccoli in the teeth?

Who in your life, work, or financial world needs to hear something they may not want—but truly need—to hear?

And most importantly: Who have you empowered to say it to you?

NWWW Podcast

Quote O' The Week

Kim Scott is a bestselling author, executive coach, and former tech leader at Google and Apple, best known for her book Radical Candor, which teaches how to give feedback that’s both caring and direct.

Kim Scott

“Radical candor is saying what you think while also caring personally.”

Weekly Market Update

Most markets took a half-step back this week, driven predominantly by a big down day on Friday:

- 0.31% .SPX (500 U.S. large companies)

- 0.56% IWD (U.S. large value companies)

- 0.62% IWM (U.S. small companies)

+ 0.01% IWN (U.S. small value companies)

- 0.48% EFV (International value companies)

- 0.42% SCZ (International small companies)

- 0.17% VGIT (U.S. intermediate-term Treasury bonds

Earnings Season & Margin Watch

Contributed by Tony Welch, CFA®, CFP®, CMT, Chief Investment Officer, SignatureFD

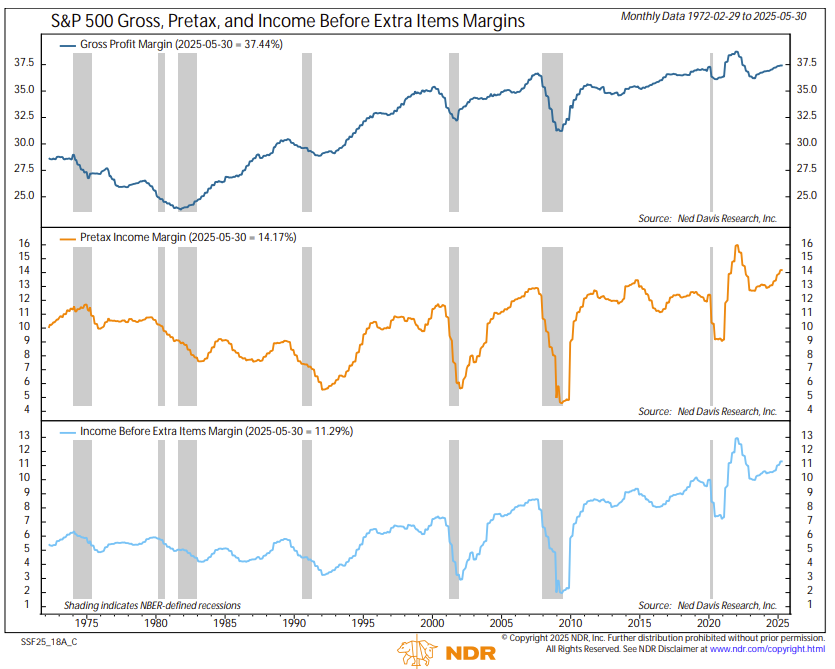

With Q2 earnings season kicking off this week, all eyes will be on corporate margins. The S&P 500 gained more than 10% in the second quarter, a strong run that came despite rising tariffs and signs of slowing economic growth. The chart below shows that gross margins for the S&P 500 rose slightly between March and June, up three basis points, while pretax and net margins dipped modestly.

That stability is encouraging, but it also creates a downside risk. If gross margins begin to slip under the weight of higher input costs and tariff pressures, earnings expectations for the second half of the year, currently near 13% year-over-year growth, may prove too optimistic. This will be especially relevant for small caps, which lack the pricing power and political influence that larger firms enjoy. The takeaway is simple - margins will drive the narrative this quarter. If they hold, the bull case for equities remains intact. If they crack, optimistic sentiment could reverse.

Chart O’ The Week

The Message from Our Indicators

This week’s economic data continues to support our view of a soft landing. Initial jobless claims fell to 227,000, the fourth consecutive weekly decline, showing that layoffs remain subdued. At the same time, continuing claims rose to 1.965 million, the highest level since late 2021, suggesting that it is taking longer for unemployed workers to find new jobs. This low-firing, low-hiring environment points to a gradually cooling labor market, not one in free fall.

Housing data was less reassuring. New home sales and housing starts are trending toward the lower end of their three-year range, and affordability remains a significant headwind with mortgage rates remaining near 6.8%. Builders also face labor shortages tied to tighter immigration enforcement and cost pressures from tariffs. These dynamics are adding downside risk to economic growth in the second half of the year, even though we believe a recession still does not appear imminent.

Markets head into earnings season with somewhat elevated expectations. The S&P 500 is richly valued, and consensus estimates are calling for earnings growth to accelerate in the back half of 2025. That may prove ambitious unless economic growth reaccelerates. For now, the market’s uptrend remains intact as long as earnings do not contract. Our indicators remain constructive, but we’re closely monitoring trends in the housing market and corporate earnings.

If you’re earning this weekend, I salute you. If you’re spending, all the same. :-)

Tim

Excellent article! Thank you for the valuable advice and suggestions.